Form Ct-1120i - Computation Of Interest Due On Underpayment Of Estimated Tax - 2012 Page 2

ADVERTISEMENT

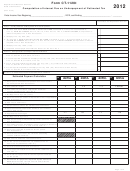

Part IV– Computation of Interest

10a. First installment: Enter the required installment amount due on the fifteenth day

of the third month. See instructions. . .............................................................................................................. 10a

10b. Enter payments made or credits received on or before the fifteenth day of the third month. ......................... 10b

10c. First installment underpayment balance: Subtract Line 10b from Line 10a. ................................................... 10c

10. Interest due - Sixteenth day of the third month through the fifteenth day of the

fourth month. Multiply Line 10c by .01 if greater than zero. ......................................................................... 10

11a. Enter payments made or credits received on or before the fifteenth day of the fourth month. . ...................... 11a

11b. First installment underpayment balance: Subtract Line 11a from Line 10c. ................................................... 11b

11. Interest due - Sixteenth day of the fourth month through the fifteenth day of the

fifth month. Multiply Line 11b by .01 if greater than zero. ..............................................................................11

12a. Enter payments made or credits received on or before the fifteenth day of the fifth month. . ......................... 12a

12b. First installment underpayment balance: Subtract Line 12a from Line 11b. ................................................... 12b

12. Interest due - Sixteenth day of the fifth month through the fifteenth day of the

sixth month. Multiply Line 12b by .01 if greater than zero. ........................................................................... 12

13a. Second installment: Enter payments made or credits received on or before the fifteenth day

of the sixth month. .......................................................................................................................................... 13a

13b. First installment underpayment balance: Subtract Line 13a from Line 12b. ................................................... 13b

13c. Enter the second required installment amount due on the fifteenth day of the sixth month. See instructions. . 13c

13d. Second installment underpayment balance: Add Line 13b and Line 13c. ...................................................... 13d

13. Interest due - Sixteenth day of the sixth month through the fifteenth day of the

seventh month. Multiply Line 13d by .01 if greater than zero. ..................................................................... 13

14a. Enter payments made or credits received on or before the fifteenth day of the seventh month. .................... 14a

14b. Second installment underpayment balance: Subtract Line 14a from Line 13d. .............................................. 14b

14. Interest due - Sixteenth day of the seventh month through the fifteenth day of the

eighth month. Multiply Line 14b by .01 if greater than zero. ........................................................................ 14

15a. Enter payments made or credits received on or before the fifteenth day of the eighth month. ...................... 15a

15b. Second installment underpayment balance: Subtract Line 15a from Line 14b. ............................................. 15b

15. Interest due - Sixteenth day of the eighth month through the fifteenth day of the

ninth month. Multiply Line 15b by .01 if greater than zero. .......................................................................... 15

16a. Third installment: Enter payments made or credits received on or before the fifteenth day

of the ninth month. .......................................................................................................................................... 16a

16b. Second installment underpayment balance: Subtract Line 16a from Line 15b. .............................................. 16b

16c. Enter the third required installment amount due on the fifteenth day of the ninth month. See instructions. . . 16c

16d. Third installment underpayment balance: Add Line 16b and Line 16c. .......................................................... 16d

16. Interest due - Sixteenth day of the ninth month through the fifteenth day of the

tenth month. Multiply Line 16d by .01 if greater than zero. .......................................................................... 16

17a. Enter payments made or credits received on or before the fifteenth day of the tenth month. . ....................... 17a

17b. Third installment underpayment balance: Subtract Line 17a from Line 16d. .................................................. 17b

17. Interest due - Sixteenth day of the tenth month through the fifteenth day of the

eleventh month. Multiply Line 17b by .01 if greater than zero. .................................................................... 17

18a. Enter payments made or credits received on or before the fifteenth day of the eleventh month. ................... 18a

18b. Third installment underpayment balance: Subtract Line 18a from Line 17b. .................................................. 18b

18. Interest due - Sixteenth day of the eleventh month through the fifteenth day of the

twelfth month. Multiply Line 18b by .01 if greater than zero. ........................................................................ 18

19a. Fourth installment: Enter payments made or credits received on or before the fifteenth day

of the twelfth month. ....................................................................................................................................... 19a

19b. Third installment underpayment balance: Subtract Line 19a from Line 18b. .................................................. 19b

19c. Enter the fourth required installment amount due on the fifteenth day of the twelfth month. See instructions. . .. 19c

19d. Fourth installment underpayment balance: Add Line 19b and Line 19c. ........................................................ 19d

19. Interest due - Sixteenth day of the twelfth month through the fifteenth day of the

thirteenth month. Multiply Line 19d by .01 if greater than zero. .................................................................. 19

20a. Enter payments made or credits received on or before the fifteenth day of the thirteenth month. . ................ 20a

20b. Fourth installment underpayment balance: Subtract Line 20a from Line 19d. ............................................... 20b

20. Interest due - Sixteenth day of the thirteenth month through the fifteenth day of the

fourteenth month. Multiply Line 20b by .01 if greater than zero. ................................................................. 20

21a. Enter payments made or credits received on or before the fifteenth day of the fourteenth month. . ............... 21a

21b. Fourth installment underpayment balance: Subtract Line 21a from Line 20b. ................................................ 21b

21. Interest due - Sixteenth day of the fourteenth month through the fifteenth day of the

fifteenth month. Multiply Line 21b by .01 if greater than zero. ..................................................................... 21

22a. Enter payments made or credits received on or before the fifteenth day of the fifteenth month. . .................. 22a

22b. Fourth installment underpayment balance: Subtract Line 22a from Line 21b. ................................................ 22b

22. Interest due - Sixteenth day of the fifteenth month to the first day of the sixteenth month

Multiply Line 22b by .01 if greater than zero. .................................................................................................. 22

23. Total interest due: Add Lines 10 through 22. Enter here and on the appropriate

Connecticut tax form. ................................................................................................................................... 23

Form CT-1120I (Rev. 01/13)

Page 2 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4