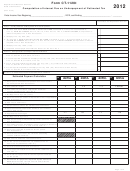

Form Ct-1120i - Computation Of Interest Due On Underpayment Of Estimated Tax - 2012 Page 4

ADVERTISEMENT

Taxpayers can use certain private delivery services, in addition

to the U.S. Postal Service, for delivering returns, claims,

statements or other documents, or payments, and meet the

timely filing/payment rules. The timely filed and timely payment

rules will be met if the U.S. Postal Service cancellation date, or

the date recorded or marked by a designated private delivery

service (PDS) using a designated type of service, is on or

before the due date. Not all types of service provided by these

designated PDSs qualify.

The following are the designated PDSs and designated types

of service at the time of publication:

Federal Express (FedEx)

United Parcel Service (UPS)

• FedEx Priority Overnight

• UPS Next Day Air

• FedEx Standard Overnight

• UPS Next Day Air Saver

• FedEx 2Day

• UPS 2nd Day Air

• FedEx International Priority

• UPS 2nd Day Air A.M.

• FedEx International First

• UPS Worldwide Express Plus

• UPS Worldwide Express

DHL Express (DHL)

• DHL Same Day Service

This list is subject to change. See Policy Statement 2012(2),

Designated Private Delivery Services, and Designated Types

of Service.

Taxpayer Service Center

The Department of Revenue Services (DRS)

Taxpayer Service Center (TSC) allows taxpayers

to electronically file, pay, and manage state tax responsibilities.

To make electronic transactions or administer your tax account

online,visit and select Business.

Form CT-1120I (Rev. 01/13)

Page 4 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4