Form 71a010 - Vehicle Condition Refund Application

ADVERTISEMENT

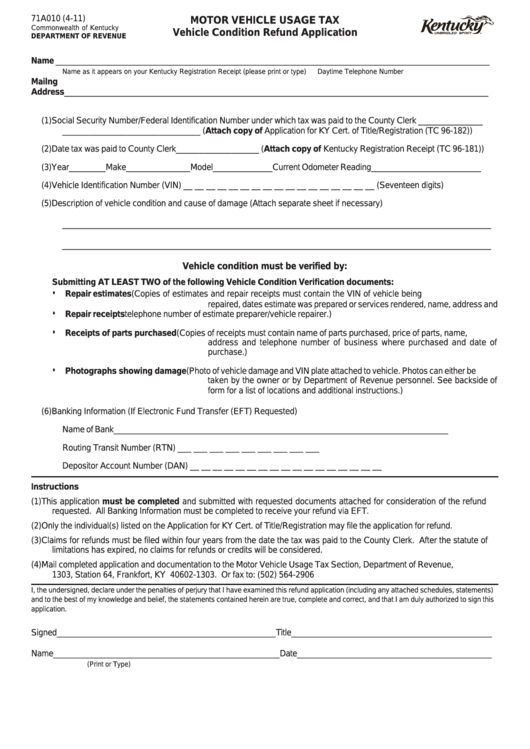

71A010 (4-11)

MOTOR VEHICLE USAGE TAX

Commonwealth of Kentucky

Vehicle Condition Refund Application

DEPARTMENT OF REVENUE

Name _______________________________________________________________________________________________

Name as it appears on your Kentucky Registration Receipt (please print or type)

Daytime Telephone Number

Mailng

Address_____________________________________________________________________________________________

P.O. Box or Number and Street

City or Town

County

State

ZIP Code

(1)

Social Security Number/Federal Identification Number under which tax was paid to the County Clerk ______________

______________________________ (Attach copy of Application for KY Cert. of Title/Registration (TC 96-182))

(2)

Date tax was paid to County Clerk__________________ (Attach copy of Kentucky Registration Receipt (TC 96-181))

(3)

Year________Make______________Model_____________Current Odometer Reading________________________

(4)

Vehicle Identification Number (VIN) __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ (Seventeen digits)

(5)

Description of vehicle condition and cause of damage (Attach separate sheet if necessary)

______________________________________________________________________________________________

______________________________________________________________________________________________

Vehicle condition must be verified by:

Submitting AT LEAST TWO of the following Vehicle Condition Verification documents:

•

Repair estimates

(Copies of estimates and repair receipts must contain the VIN of vehicle being

repaired, dates estimate was prepared or services rendered, name, address and

•

Repair receipts

telephone number of estimate preparer/vehicle repairer.)

•

Receipts of parts purchased

(Copies of receipts must contain name of parts purchased, price of parts, name,

address and telephone number of business where purchased and date of

purchase.)

•

Photographs showing damage

(Photo of vehicle damage and VIN plate attached to vehicle. Photos can either be

taken by the owner or by Department of Revenue personnel. See backside of

form for a list of locations and additional instructions.)

(6)

Banking Information (If Electronic Fund Transfer (EFT) Requested)

Name of Bank_________________________________________________________________________

Routing Transit Number (RTN) ___ ___ ___ ___ ___ ___ ___ ___ ___

Depositor Account Number (DAN) __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __

Instructions

(1)

This application must be completed and submitted with requested documents attached for consideration of the refund

requested. All Banking Information must be completed to receive your refund via EFT.

(2)

Only the individual(s) listed on the Application for KY Cert. of Title/Registration may file the application for refund.

(3)

Claims for refunds must be filed within four years from the date the tax was paid to the County Clerk. After the statute of

limitations has expired, no claims for refunds or credits will be considered.

(4)

Mail completed application and documentation to the Motor Vehicle Usage Tax Section, Department of Revenue, P.O. Box

1303, Station 64, Frankfort, KY 40602-1303. Or fax to: (502) 564-2906

I, the undersigned, declare under the penalties of perjury that I have examined this refund application (including any attached schedules, statements)

and to the best of my knowledge and belief, the statements contained herein are true, complete and correct, and that I am duly authorized to sign this

application.

Signed________________________________________________Title____________________________________________

Name__________________________________________________Date___________________________________________

(Print or Type)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2