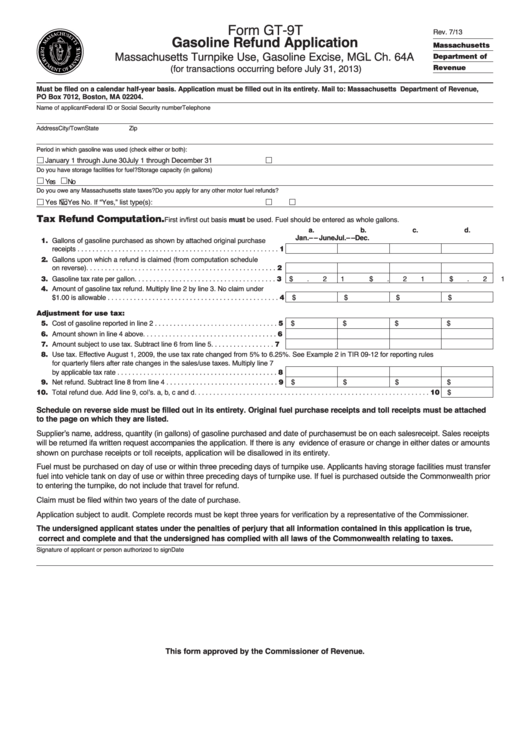

Form GT-9T

Rev. 7/13

Gasoline Refund Application

Massachusetts

Massachusetts Turnpike Use, Gasoline Excise, MGL Ch. 64A

Department of

Revenue

(for transactions occurring before July 31, 2013)

Must be filed on a calendar half-year basis. Application must be filled out in its entirety. Mail to: Massachusetts Department of Revenue,

PO Box 7012, Boston, MA 02204.

Name of applicant

Federal ID or Social Security number

Telephone

Address

City/Town

State

Zip

Period in which gasoline was used (check either or both):

January 1 through June 30

July 1 through December 31

Do you have storage facilities for fuel?

Storage capacity (in gallons)

Yes

No

Do you owe any Massachusetts state taxes?

Do you apply for any other motor fuel refunds?

Yes

No

Yes

No. If “Yes,” list type(s):

Tax Refund Computation.

First in/first out basis must be used. Fuel should be entered as whole gallons.

a.

b.

c.

d.

Jan.–Mar.

Apr.– June

Jul.–Sep.

Oct.–Dec.

11. Gallons of gasoline purchased as shown by attached original purchase

receipts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

12. Gallons upon which a refund is claimed (from computation schedule

on reverse) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

13. Gasoline tax rate per gallon . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

$

.21

$

.21

$

.21

$

.21

14. Amount of gasoline tax refund. Multiply line 2 by line 3. No claim under

$1.00 is allowable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

$

$

$

$

Adjustment for use tax:

15. Cost of gasoline reported in line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

$

$

$

$

16. Amount shown in line 4 above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

17. Amount subject to use tax. Subtract line 6 from line 5 . . . . . . . . . . . . . . . . . 7

18. Use tax. Effective August 1, 2009, the use tax rate changed from 5% to 6.25%. See Example 2 in TIR 09-12 for reporting rules

for quarterly filers after rate changes in the sales/use taxes. Multiply line 7

by applicable tax rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

19. Net refund. Subtract line 8 from line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

$

$

$

$

10. Total refund due. Add line 9, col’s. a, b, c and d . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

$

Schedule on reverse side must be filled out in its entirety. Original fuel purchase receipts and toll receipts must be attached

to the page on which they are listed.

Supplier’s name, address, quantity (in gallons) of gasoline purchased and date of purchase must be on each sales receipt. Sales receipts

will be returned if a written request accompanies the application. If there is any evidence of erasure or change in either dates or amounts

shown on purchase receipts or toll receipts, application will be disallowed in its entirety.

Fuel must be purchased on day of use or within three preceding days of turnpike use. Applicants having storage facilities must transfer

fuel into vehicle tank on day of use or within three preceding days of turnpike use. If fuel is purchased outside the Commonwealth prior

to entering the turnpike, do not include that travel for refund.

Claim must be filed within two years of the date of purchase.

Application subject to audit. Complete records must be kept three years for verification by a representative of the Commissioner.

The undersigned applicant states under the penalties of perjury that all information contained in this application is true,

correct and complete and that the undersigned has complied with all laws of the Commonwealth relating to taxes.

Signature of applicant or person authorized to sign

Date

This form approved by the Commissioner of Revenue.

1

1 2

2