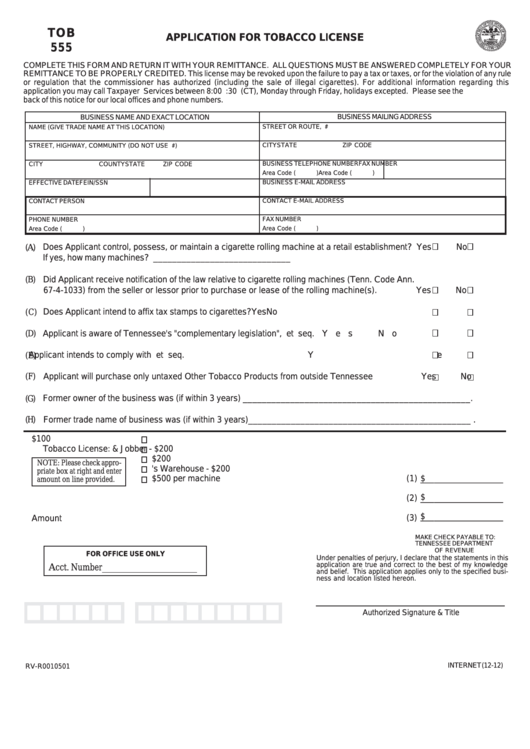

TOB

APPLICATION FOR TOBACCO LICENSE

555

COMPLETE THIS FORM AND RETURN IT WITH YOUR REMITTANCE. ALL QUESTIONS MUST BE ANSWERED COMPLETELY FOR YOUR

REMITTANCE TO BE PROPERLY CREDITED. This license may be revoked upon the failure to pay a tax or taxes, or for the violation of any rule

or regulation that the commissioner has authorized (including the sale of illegal cigarettes). For additional information regarding this

application you may call Taxpayer Services between 8:00 a.m. and 4:30 p.m. (CT), Monday through Friday, holidays excepted. Please see the

back of this notice for our local offices and phone numbers.

BUSINESS MAILING ADDRESS

BUSINESS NAME AND EXACT LOCATION

STREET OR ROUTE, P.O. BOX #

NAME (GIVE TRADE NAME AT THIS LOCATION)

STREET, HIGHWAY, COMMUNITY (DO NOT USE P.O. BOX #)

CITY

STATE

ZIP CODE

BUSINESS TELEPHONE NUMBER

FAX NUMBER

CITY

COUNTY

STATE

ZIP CODE

Area Code (

)

Area Code (

)

BUSINESS E-MAIL ADDRESS

EFFECTIVE DATE

FEIN/SSN

CONTACT PERSON

CONTACT E-MAIL ADDRESS

FAX NUMBER

PHONE NUMBER

Area Code (

)

Area Code (

)

Does Applicant control, possess, or maintain a cigarette rolling machine at a retail establishment? Yes

No

(A)

If yes, how many machines? _____________________________

Did Applicant receive notification of the law relative to cigarette rolling machines (Tenn. Code Ann.

(B)

67-4-1033) from the seller or lessor prior to purchase or lease of the rolling machine(s).

Yes

No

(C)

Does Applicant intend to affix tax stamps to cigarettes?

Yes

No

(D)

Applicant is aware of Tennessee's "complementary legislation", T.C.A. Section 67-4-2601 et seq. Yes

No

Applicant intends to comply with T.C.A. Section 67-4-2601 et seq.

Yes

No

(E)

(F)

Applicant will purchase only untaxed Other Tobacco Products from outside Tennessee

Yes

No

Former owner of the business was (if within 3 years) ________________________________________________ .

(G)

(H)

Former trade name of business was (if within 3 years) _______________________________________________ .

1. Check Type of

A. Tobacco Distributor - $100

Tobacco License:

B. Wholesale Dealer & Jobber - $200

C. Manufacturing Distributor - $200

NOTE: Please check appro-

D. Tobacco Manufacturer's Warehouse - $200

priate box at right and enter

E. Cigarette Rolling Machine Operator - $500 per machine ..........

(1)

$ _ _________________

amount on line provided.

$

(2)

__________________

2.Penalty - Enter the amount of penalty as calculated in the instructions ......................................

(3) $

__________________

3.Total Amount Due..................................................................................................................

MAKE CHECK PAYABLE TO:

TENNESSEE DEPARTMENT

OF REVENUE

FOR OFFICE USE ONLY

Under penalties of perjury, I declare that the statements in this

application are true and correct to the best of my knowledge

Acct. Number ____________________

and belief. This application applies only to the specified busi-

ness and location listed hereon.

Authorized Signature & Title

INTERNET (12-12)

RV-R0010501

1

1 2

2