For additional information, contact the Taxpayer Services Division in one of our Department of Revenue Offices:

Memphis

Chattanooga

Jackson

Johnson City

Knoxville

Nashville

(731) 423-5747

(423) 854-5321

(865) 594-6100

(901) 213-1400

(615) 253-0600

(423) 634-6266

3150 Appling Road

3rd Floor

Suite 350

Suite 340

204 High Point Drive

Room 606

Lowell Thomas Building

State Office Building

Bartlett, TN

Andrew Jackson Building

State Office Building

500 Deaderick Street

540 McCallie Avenue

225 Martin Luther King Blvd.

531 Henley Street

Tennessee residents can also call our statewide toll free number at 1-800-342-1003.

Out-of-state callers must dial (615) 253-0600.

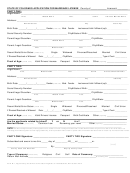

Instructions

Each person engaged in the business of selling, distributing, or handling tobacco products at the wholesale level in this state and each

cigarette rolling machine operator in this state are required to file an application with the Department of Revenue on or before May 31 of

each year for a license to engage in such business. Any person commencing business subsequent to May 31 shall apply for such license

prior to the commencement of business. The license will expire on May 31 of each year.

Line 1:

What Kind of Tobacco License Do I Need?

Tobacco Distributor - $100 for each wholesale location where tobacco products are received or ordered for delivery to someone

other than the ultimate consumer.

If you receive, purchase, or sell tobacco products as a secondary wholesaler and acquire only pre-stamped cigarettes and/or

other tobacco products on which the tax has been previously paid, but do not sell to the ultimate consumer, you need a Tobacco

Distributor's license.

Wholesale Dealer and Jobber - $200 for each separate warehouse.

If you maintain wholesale facilities in one or more permanent locations; if you are in the business of receiving, storing,

purchasing, selling at wholesale, importing unstamped tobacco products, or otherwise handling tobacco products for resale at

a wholesale price; and if you sell only to other licensed wholesalers and distributors or retailers but not to the ultimate

consumer, you need a Wholesale Dealer & Jobber license. This license requires a minimum $2,000 bond.

Manufacturing Distributor - $200 for each plant or processing location.

If you are engaged in the business of manufacturing or processing consumable tobacco products and you have a manufacturing

plant located in this state, you need a Manufacturing Distributor license. This license requires a minimum $2,000 bond.

Tobacco Manufacturer's Warehouse - $200 for each storage warehouse.

If you are a manufacturer with a warehouse, building, or structure maintained separately from your manufacturing operation

where you store tobacco products for distribution, and where you retail title to and control of distribution of such tobacco

products, you need a Tobacco Manufacturer's Warehouse license. This license requires a minimum $20,000 bond.

Cigarette Rolling Machine Operator - $500 for each cigarette rolling machine.

If you control, possess, or maintain a cigarette rolling machine at a retail establishment that enables any person to process

tobacco into a roll or a tube, you need a Cigarette Rolling Machine Operator license. "Cigarette Rolling Machine" means a

machine at a retail establishment that enables any person to process at that establishment tobacco into a roll or tube. A copy

of your tobacco product manufacturer's permit, issued by the TTB, must be submitted with this application.

Line 2: Any person failing to apply for a tobacco license prior to the commencement of doing business will be subject to a penalty in

accordance with Tenn. Code Ann. Section 67-4-1015. The amount of penalty is equal to the amount of the license fee for each

month (or part of month) in which activity occurred without the appropriate license.

Amount of license fee: _____________ x Number of months or partial months in which you conducted business without a

license: ___________ = [Amount of Penalty].

For example: If you begin acting as a Tobacco Distributor on October 15 but failed to apply for a tobacco license until

December 1, you would be subject to a penalty in the amount of $200.

Line 3: Enter the total of Lines 1 and 2. This is the amount due. Sign the application form. Send the completed and signed application and

your payment, made payable to the Tennessee Department of Revenue, to the Tennessee Department of Revenue, Andrew Jackson

State Office Building, 500 Deaderick Street, Nashville, Tennessee 37242.

For additional information or assistance regarding this application, contact the Department of Revenue. Tennessee residents may use the

toll-free number, 1-800-342-1003. Nashville area and out-of-state callers may call (615) 253-0600. You may call either of these numbers

between 8:00 a.m. and 4:30 p.m. (CT), Monday through Friday, holidays excepted. You may direct any correspondence or submit written

information to the following address: Tennessee Department of Revenue, Andrew Jackson State Office Building, 500 Deaderick Street,

Nashville, Tennessee 37242.

INTERNET (12-12)

1

1 2

2