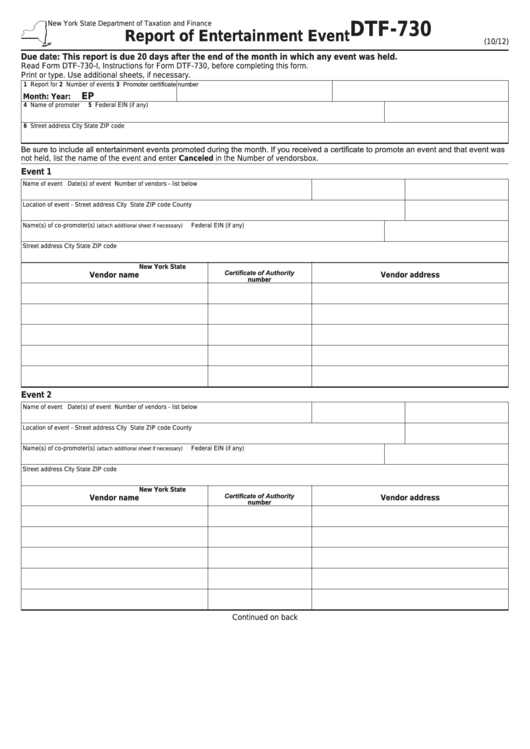

Form Dtf-730 - Report Of Entertainment Event

ADVERTISEMENT

New York State Department of Taxation and Finance

DTF-730

Report of Entertainment Event

(10/12)

Due date: This report is due 20 days after the end of the month in which any event was held.

Read Form DTF‑730‑I, Instructions for Form DTF-730, before completing this form.

Print or type. Use additional sheets, if necessary.

3 Promoter certificate number

1 Report for

2 Number of events

EP

Month:

Year:

4 Name of promoter

5 Federal EIN (if any)

6 Street address

City

State

ZIP code

Be sure to include all entertainment events promoted during the month. If you received a certificate to promote an event and that event was

not held, list the name of the event and enter Canceled in the Number of vendors box.

Event 1

Name of event

Date(s) of event

Number of vendors ‑ list below

Location of event ‑ Street address

City

State

ZIP code

County

Name(s) of co‑promoter(s)

Federal EIN (if any)

(attach additional sheet if necessary)

Street address

City

State

ZIP code

New York State

Certificate of Authority

Vendor name

Vendor address

number

Event 2

Name of event

Date(s) of event

Number of vendors ‑ list below

Location of event ‑ Street address

City

State

ZIP code

County

Name(s) of co‑promoter(s)

Federal EIN (if any)

(attach additional sheet if necessary)

Street address

City

State

ZIP code

New York State

Certificate of Authority

Vendor name

Vendor address

number

Continued on back

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2