Form Dtf-730 - Report Of Entertainment Event Page 2

ADVERTISEMENT

DTF-730 (10/12)

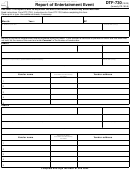

Event 3

Name of event

Date(s) of event

Number of vendors ‑ list below

Location of event ‑ Street address

City

State

ZIP code

County

Name(s) of co‑promoter(s)

Federal EIN (if any)

(attach additional sheet if necessary)

Street address

City

State

ZIP code

New York State

Certificate of Authority

Vendor name

Vendor address

number

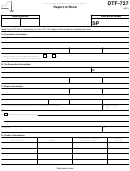

Event 4

Name of event

Date(s) of event

Number of vendors ‑ list below

Location of event ‑ Street address

City

State

ZIP code

County

Name(s) of co‑promoter(s)

Federal EIN (if any)

(attach additional sheet if necessary)

Street address

City

State

ZIP code

New York State

Certificate of Authority

Vendor name

Vendor address

number

Certification

I certify that the above statements are true, complete, and correct, and that no material information has been omitted. I make these

statements with the knowledge that willfully providing false or fraudulent information with the intent to evade tax may constitute a felony or

other crime under New York State Law, punishable by a substantial fine and possible jail sentence. I also understand that the Tax Department

is authorized to investigate the validity of any information entered on this document.

Signature

Title

Date

Notice: Any entertainment promoter who fails to comply with any provision(s) of New York State Tax Law Article 28 or any regulation

prescribed by the Commissioner of Taxation and Finance, pertaining to an entertainment promoter’s requirements with respect to

entertainment events, may be subject to denial or revocation of any Entertainment Promoter Certificates as outlined in New York State Tax

Law section 1134(c).

In addition, a noncomplying promoter may be subject to civil penalties under section 1145(f) and penal provisions under New York State Tax

Law section 1817.

See Instructions for where to file. Use additional sheets if necessary.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2