Form M&r - Meals & Rentals Tax Worksheet - 2001

ADVERTISEMENT

FORM

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

M&R

MEALS & RENTALS TAX BOOKLET

General Information

GENERAL INFORMATION

RECORD KEEPING REQUIREMENTS

All Meals & Rentals Tax operators are required to keep sufficient records to substantiate their reported receipts. These records must include properly dated

source documents, and the summary documents used to calculate the tax due. As required by Rev. 706.01, operators must maintain for a minimum of three

(3) years, all records including the Meals & Rentals Tax worksheet or a hard copy of the PCFILING, guest checks/registration cards, cash receipts/sales

journal, cash disbursement/purchases journal, general ledger, payroll records, cash register tapes, bank records and any other source documents required

to support entries in an accounting record as either taxable or non-taxable sales. Operators whose sales include non-taxable items must keep adequate

records to substantiate non-taxable sales or all sales will be considered taxable. [Rev. 706.01]

FAILURE TO MAINTAIN ADEQUATE RECORDS

Failure to keep adequate records may result in the loss of any 3% commissions taken, the assessment of a 10%, 25% or 50% penalty on any additional tax

due and/or the suspension/revocation of their operator's license.

3% COMMISSION REQUIREMENT

Per RSA 78-A:7,III operators are permitted to take a commission equal to 3% of the tax due if they meet all of the following requirements: (1) keep the

prescribed records (see above), (2) file the return timely, (3) pay the tax due timely and (4) have no outstanding prior balance due for tax, interest and/or

penalties and (5) follow the appropriate method of filing.

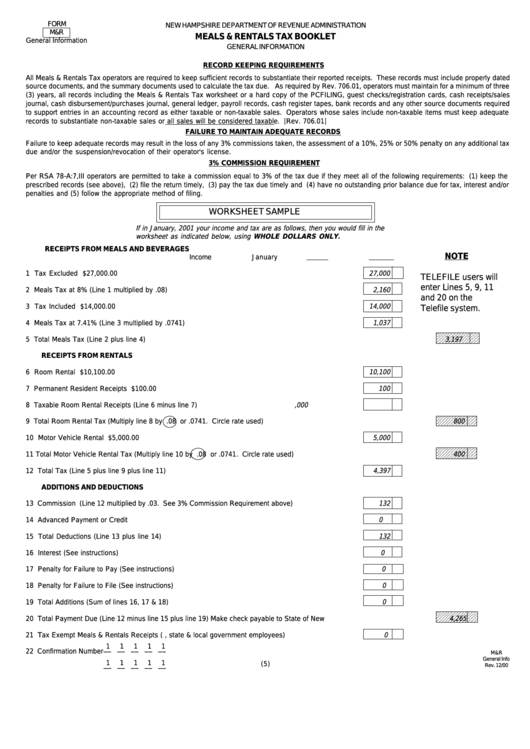

WORKSHEET SAMPLE

If in January, 2001 your income and tax are as follows, then you would fill in the

worksheet as indicated below, using WHOLE DOLLARS ONLY.

RECEIPTS FROM MEALS AND BEVERAGES

NOTE

Income

January

1 Tax Excluded Receipts.................................................................................................

$27,000.00

27,000

TELEFILE users will

enter Lines 5, 9, 11

2 Meals Tax at 8% (Line 1 multiplied by .08).................................................................................................

2,160

and 20 on the

14,000

3 Tax Included Receipts..................................................................................................

$14,000.00

Telefile system.

1,037

4 Meals Tax at 7.41% (Line 3 multiplied by .0741)........................................................................................

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

5 Total Meals Tax (Line 2 plus line 4).....................................................................................................................................................

3,197

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

RECEIPTS FROM RENTALS

10,100

6 Room Rental Receipts...................................................................................................

$10,100.00

7 Permanent Resident Receipts .......................................................................................

$100.00

100

8 Taxable Room Rental Receipts (Line 6 minus line 7)................................................... ..............................

10,000

1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4

9 Total Room Rental Tax (Multiply line 8 by .08 or .0741. Circle rate used)........................................................................................

800

1 2 3 4 5 6 7 8 9 0 1 2 3 4

5,000

10 Motor Vehicle Rental Receipts.....................................................................................

$5,000.00

1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4

11 Total Motor Vehicle Rental Tax (Multiply line 10 by .08 or .0741. Circle rate used).........................................................................

400

1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4

12 Total Tax (Line 5 plus line 9 plus line 11)....................................................................................................

4,397

ADDITIONS AND DEDUCTIONS

13 Commission (Line 12 multiplied by .03. See 3% Commission Requirement above)................................

132

14 Advanced Payment or Credit Memo...........................................................................................................

0

15 Total Deductions (Line 13 plus line 14).....................................................................................................

132

16 Interest (See instructions)..........................................................................................................................

0

17 Penalty for Failure to Pay (See instructions)..............................................................................................

0

18 Penalty for Failure to File (See instructions)...............................................................................................

0

0

19 Total Additions (Sum of lines 16, 17 & 18).................................................................................................

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

4,265

20 Total Payment Due (Line 12 minus line 15 plus line 19) Make check payable to State of New Hampshire........................................

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

21 Tax Exempt Meals & Rentals Receipts (e.g. federal, state & local government employees).....................

0

1

1

1

1

1

__ __ __ __ __

22 Confirmation Number

M&R

General Info

1

1

1

1

1

(5)

__ __ __ __ __

Rev. 12/00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5