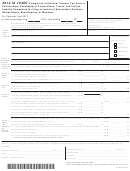

Form T-S- Wisconsin Telco Statewide Summary Return - 2013 Page 4

ADVERTISEMENT

T-S

SCHEDULE Y-P:

SUMMARY OF ACCOUNTING RECORDS

2013

E

page 2

WHAT TO REPORT: All Wisconsin assets (all accounts) for the company are summarized and reported by Property Type in Y-P. See individual schedules in the T-P Form for

descriptions of each Property Type. Include everything just as it appears in your accounting records. Include projects in progress (WIP) and fully depreciated items still on hand by

Property Type on each line of Y-P. Report work in progress (WIP) by Property Type on the designated line in each individual schedule of the T-P. If you are unable to report

personal property work in progress by schedule (Property Type), report it on Schedule O.

TOTAL PERSONAL PROPERTY ORIGINAL COST FROM YOUR ACCOUNTING RECORDS

ENTER NUMBERS IN COLUMN 4 WITH NEGATIVE (-) SIGN

Column 1

Column 2

Column 3

Column 4

Column 5

Balance as of Jan 1

Additions During

Deletions During

Balance January 1

PROPERTY TYPE

2012

2012

2012

2013

1

Exempt Computers, Software & Faxes

C

0

2

Copiers & Telephone Systems

D

0

Equipment Shelters on Non-Owned or Locally

3

E

0

Assessed Land

4

Furniture and Tools

F

0

5

Telephone Central Office Equipment & Antennas

G

0

6

L

All Non-Owned Items

0

7

LHI

Leasehold Improvements

0

8

Other Taxable Property Not on Other Schedules

O

0

9

Supplies

S

0

10

T

Towers

0

11

Operational Fiber Optic Cable (Lit)

C1-L

0

12

Non-Operational Fiber Optic Cable (Dark)

C1-D

0

13

C-2

Metallic Cable & Poles

0

14

Coaxial Cable

C-3

0

15

*

-

Other Non-Taxable Assets

0

16

TOTAL OF ALL ABOVE LINES

0

0

0

0

Enter assets located in Wisconsin on Line 15 not taxable but carried on your books - i.e., vehicles used over the road.

*

SCHEDULE Y-R:

SUMMARY OF ACCOUNTING RECORDS

WHAT TO REPORT:

All Wisconsin real estate assets and accounts for the company are summarized and reported by Property Type or

Account in Y-R. Include everything just as it appears in your accounting records including construction in progress.

Enter your balance as of January 1, 2012 in Column 2. Include all additions and deletions made during 2012 in Cols. 3

HOW TO REPORT:

and 4. (Column 5 should reflect your accounting records for real estate on January 1, 2013.)

TOTAL REAL ESTATE ORIGINAL COSTS FROM YOUR ACCOUNTING RECORDS

ENTER NUMBERS IN COLUMN 4 WITH NEGATIVE (-) SIGN

Column 1

Column 2

Column 3

Column 4

Column 5

PROPERTY TYPE

Balance as of January 1

Additions During

Deletions During

Balance January 1

2012

2012

2012

2013

OR ACCOUNT

Land Size (Acres or S. F.)

1

-

Land Cost

2

0

Land Improvement Cost

3

0

Building(s) Cost

4

0

Building Components Cost*

5

0

Construction in Progress Costs

6

(REAL ESTATE ONLY)

0

7

Other:

0

8

TOTAL OF LINES 2 through 7

0

0

0

0

* Building Components normally assessed as real estate (heating, lighting, remodeling, etc.) which you have capitalized as personal property.

NOTE: Attach an itemized list of the Building Components and related costs included in this figure.

Wisconsin Department of Revenue 2/4/2013

- 6 -

PA-751 S (R. 01-13)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4