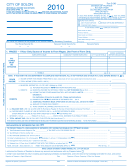

Form L-1040 - Individual Income Tax Return - City Of Lapeer - 2002 Page 2

ADVERTISEMENT

NAME(S) AS SHOWN ON FRONT

SOCIAL SECURITY NUMBER

FAILURE TO ATTACH DOCUMENTATION OR ATTACHING INCORRECT OR INCOMPLETE DOCUMENTATION

WILL RESULT IN DEDUCTIONS AND LOSSES BEING DISALLOWED OR DELAY PROCESSING OF RETURN

27. WAGE ALLOCATION

COMPUTATION OF LAPEER WAGES OF A NON-RESIDENT WHO WORKS BOTH IN AND OUTSIDE OF LAPEER FOR THE SAME EMPLOYER.

WAGES FROM LINE 27f ARE TO BE ENTERED ON THE APPROPRIATE LINE OF PAGE 1, LINES 2a THROUGH 2e, COLUMN "WAGES, ETC W-2 FORM, BOX 1".

27a.

Employer name. ( A COMPUTATION MUST BE MADE FOR EACH EMPLOYER)

27a.

1

2

3

4

27b.

Actual number of days or hours worked for employer. (DO NOT INCLUDE WEEKENDS

27b.

OFF, HOLIDAYS, SICK OR VACATION DAYS, ETC. IN AMOUNTS ON 27b AND 27c

27c.

Actual number of days or hours worked in Lapeer

27c.

27d.

Percentage of days or hours worked in Lapeer. Line 27c divided by line 27b

27d.

%

%

%

%

27e.

Total wages shown on LW-2 or W-2 box 1.

27e.

.00

.00

.00

.00

.00

27f.

Wages earned in Lapeer. Line 27e multiplied by percentage on line 27d

27f.

.00

.00

.00

Enter on page 1, lines 2a through 2e, in column "Wages etc" the Lapeer wages from 27f for each employer.

28.

BUSINESS INCOME

.00

28a.

Net profit (or loss) from business, profession or farm. (ATTACH FEDERAL SCHEDULE C OR SCHEDULE F)

28a.

28b.

Allocation percentage from line 29g below. (IF ALL BUSINESS WAS CONDUCTED IN LAPEER ENTER 100%)

28b.

%

28c.

Allocated net profit (loss). Multiply line 28a by line 28b

28c.

.00

.00

28d.

Applicable portion of net operating loss carryover. (ATTACH SCHEDULE)

28d.

.00

28e.

Applicable portion of retirement plan deduction.

Check tip of plan

KEOGH

SEP

SIMPLE

(Attach federal schedule)

28e.

.00

28f.

Total. Lines 28c less lines 28d and 28e

ENTER HERE AND ON PAGE 1 LINE 6

28f.

29.

BUSINESS ALLOCATION FORMULA

For use by nonresidents to compute excludible business income

COLUMN 1

COLUMN 2

COLUMN 3

BUSINESS FEIN:

LOCATED EVERYWHERE

LOCATED IN LAPEER

PERCENTAGE

.00

29a.

Average net book value of real and tangible personal property.

29a.

.00

(Column 2 divided

.00

29b.

Annual gross rent paid on real property multiplied by 8.

29b.

.00

by column 1)

.00

29c.

Total property. Add lines 29a and 29b

29c.

.00

%

.00

29d.

Total wages, salaries and other compensation of all employees.

29d.

.00

%

29e.

Gross receipts from sales made or services rendered.

29e.

.00

.00

%

29f.

Total percentages. Add the percentages computed in column 3 lines 29c, 29d and 29e

29f.

%

29g.

Business Allocation Percentage. Divide line 29f by the number of factors used ENTER HERE AND ON LINE 28B ABOVE

29g.

%

30.

RENTAL REAL ESTATE, ROYALTIES, PARTNERSHIPS, TRUSTS, ETC.

THE FEDERAL RULES CONCERNING PASSIVE LOSSES ARE APPLICABLE TO LOSSES DEDUCTED ON THIS RETURN. SUBCHAPTER S GAINS ARE NOT

TAXABLE AND SUBCHAPTER S LOSSES ARE NOT DEDUCTIBLE ON INDIVIDUAL RETURNS UNDER THE LAPEER INCOME TAX ORDINANCE.

30a.

Rental real estate from federal Schedule E. (ATTACH FEDERAL SCHEDULE E AND FORM 8582)

30a.

.00

30b.

Partnership, estates, trusts from federal Schedule E. (ATTACH FEDERAL SCHEDULE E AND SCHEDULE K-1)

30b.

.00

30c.

Subchapter S distributions. (ATTACH A COPY OF FEDERAL SCHEDULE K-1)

30c.

.00

30d.

Total. Add line 30a, 30b and 30c. ENTER HERE AND ON PAGE 1, LINE 8

30d.

.00

31.

OTHER INCOME

OTHER INCOME INCLUDES: LOTTERY WINNINGS, ALIMONY RECEIVED, PROFIT SHARING PLAN DISTRIBUTIONS, PREMATURE I.R.A. DISTRIBUTIONS,

PREMATURE PENSION PLAN DISTRIBUTIONS, ETC. ATTACH COPIES OF ALL APPLICABLE FEDERAL SCHEDULES AND FORMS 1099.

RECEIVED FROM

KIND OF INCOME

AMOUNT

31a.

31a.

.00

31b.

31b.

.00

31c.

31c.

.00

31d.

31d.

.00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3