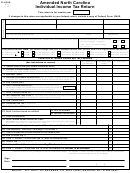

Tax Year

Page 2

Last Name (First 10 Characters)

Your Social Security Number

2012

D-400X Web-Fill

12-12

Be sure to sign and date your return on Page 4.

15.

15.

Enter amount from Line 14

16. Part-year residents and nonresidents

Complete Lines 50 through 52 on Page 4 and enter

16.

decimal amount from Line 52

17. North Carolina Taxable Income

Full-year residents enter the amount from Line 15

17.

Part-year residents and nonresidents multiply amount on Line 15 by the decimal amount on Line 16

If the amount on Line 17 is less than $68,000, use the Tax Table

18.

-

North Carolina Income Tax

18.

beginning on Page 22 of the instructions to determine your tax. If the amount on Line 17 is $68,000

or more, use the Tax Rate Schedule on Page 30 to calculate your tax.

19.

Tax Credits (From Form D-400TC, Part 4, Line 37 - You must attach Form D-400tC

19.

if you enter an amount on this line)

20.

Subtract Line 19 from Line 18

20.

21. Consumer Use Tax (See instructions on Page 10)

21.

22.

Add Lines 20 and 21

22.

23.

North Carolina Income Tax Withheld

a. Your tax withheld

23a.

(Staple original or copy of the original State

wage and tax statement(s) in lower left-hand

corner of the return)

b. Spouse’s tax withheld

23b.

24.

Other Tax Payments

a. 2012 Estimated Tax

24a.

b. Paid with Extension

24b.

c. Partnership

24c.

If you claim a partnership payment on Line 24c

or S corporation payment on Line 24d, you must

attach a copy of the NC K-1.

d. S Corporation

24d.

25. North Carolina Earned Income Tax Credit

25.

(From Form D-400TC, Part 5)

26.

Amount paid with original return (Form D-400, Line 27a) plus additional

26.

tax paid after return was filed (Do not include payments of interest or penalties.)

Total payments. Add Lines 23a through 26.

27.

27.

28.

Total of all previous refunds received or expected to be received for this taxable year

28.

(Do not include any interest you received on any refund.)

29.

Subtract Line 28 from Line 27 and enter the result

29.

a. Tax Due - If Line 22 is more than Line 29, subtract and enter the result

30.

30a.

b. Penalties

30b.

c. Interest

30c.

Exception to

d. Interest on the underpayment of estimated income tax

underpayment

30d.

(See Line instructions and enter letter in box, if applicable)

of estimated tax

$

Add Lines 30a, 30b, 30c, and 30d and enter the total - Pay This Amount

31.

31.

You can pay online. Go to and click on Electronic Services for details.

If Line 22 is less than 29, subtract and enter as Amount to be Refunded

32.

32.

1

1 2

2 3

3 4

4