Form Ct-397 - Report Of Annual License Fee Agricultural Cooperative Marketing Or Financing Corporations And District Heating/cooling Cooperatives - 2012

ADVERTISEMENT

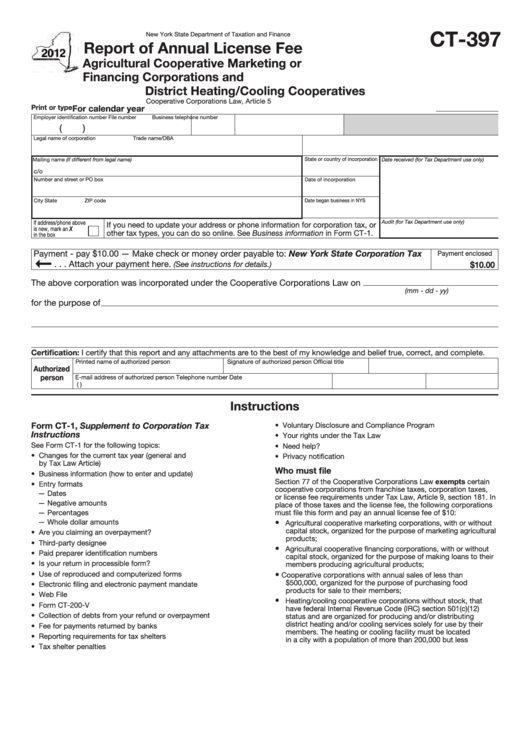

CT-397

New York State Department of Taxation and Finance

Report of Annual License Fee

Agricultural Cooperative Marketing or

Financing Corporations and

District Heating/Cooling Cooperatives

Cooperative Corporations Law, Article 5

Print or type

For calendar year

Employer identification number

File number

Business telephone number

(

)

Legal name of corporation

Trade name/DBA

State or country of incorporation

Mailing name (if different from legal name)

Date received (for Tax Department use only)

c/o

Number and street or PO box

Date of incorporation

City

State

ZIP code

Date began business in NYS

If address/phone above

Audit (for Tax Department use only)

If you need to update your address or phone information for corporation tax, or

is new, mark an X

other tax types, you can do so online. See Business information in Form CT-1.

in the box . ....................

Payment - pay $10.00 — Make check or money order payable to: New York State Corporation Tax

Payment enclosed

. . . Attach your payment here.

$10.00

(See instructions for details.)

The above corporation was incorporated under the Cooperative Corporations Law on

(mm - dd - yy)

for the purpose of

Certification: I certify that this report and any attachments are to the best of my knowledge and belief true, correct, and complete.

Printed name of authorized person

Signature of authorized person

Official title

Authorized

person

E-mail address of authorized person

Telephone number

Date

(

)

Instructions

Form CT-1, Supplement to Corporation Tax

• Voluntary Disclosure and Compliance Program

Instructions

• Your rights under the Tax Law

See Form CT-1 for the following topics:

• Need help?

• Changes for the current tax year (general and

• Privacy notification

by Tax Law Article)

Who must file

• Business information (how to enter and update)

Section 77 of the Cooperative Corporations Law exempts certain

• Entry formats

cooperative corporations from franchise taxes, corporation taxes,

— Dates

or license fee requirements under Tax Law, Article 9, section 181. In

— Negative amounts

place of those taxes and the license fee, the following corporations

— Percentages

must file this form and pay an annual license fee of $10:

— Whole dollar amounts

•

Agricultural cooperative marketing corporations, with or without

capital stock, organized for the purpose of marketing agricultural

• Are you claiming an overpayment?

products;

• Third-party designee

•

Agricultural cooperative financing corporations, with or without

• Paid preparer identification numbers

capital stock, organized for the purpose of making loans to their

• Is your return in processible form?

members producing agricultural products;

•

• Use of reproduced and computerized forms

Cooperative corporations with annual sales of less than

$500,000, organized for the purpose of purchasing food

• Electronic filing and electronic payment mandate

products for sale to their members;

• Web File

•

Heating/cooling cooperative corporations without stock, that

• Form CT-200-V

have federal Internal Revenue Code (IRC) section 501(c)(12)

• Collection of debts from your refund or overpayment

status and are organized for producing and/or distributing

district heating and/or cooling services solely for use by their

• Fee for payments returned by banks

members. The heating or cooling facility must be located

• Reporting requirements for tax shelters

in a city with a population of more than 200,000 but less

• Tax shelter penalties

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2