IT-201-V

New York State Department of Taxation and Finance

Instructions for Form IT-201-V

Payment Voucher for Income Tax Returns

Fee for payments returned by banks – The law allows the Tax

Who must use a payment voucher?

Department to charge a $50 fee when a check, money order,

If you e-filed a New York State income tax return (on

or electronic payment is returned by a bank for nonpayment.

Form IT-201 or Form IT-203) and you owe tax, you must submit

However, if an electronic payment is returned as a result of

this payment voucher, Form IT-201-V below, if you pay by

an error by the bank or the department, the department won’t

check or money order. If you authorized the Tax Department to

charge the fee. If your payment is returned, we will send a

withdraw the payment from your bank account (electronic funds

separate bill for $50 for each return or other tax document

withdrawal) or paid by credit card, do not file Form IT-201-V.

associated with the returned payment.

Also use Form IT-201-V if you previously filed your income

tax return (Form IT-201, Form IT-203, Form IT-201-X, or

Where do I send my payment and payment

Form IT-203-X) and want to make a payment for that return.

voucher?

To find out more about your payment options, visit the Tax

Send your payment and this payment voucher to:

Department’s Web site (at ).

NYS PERSONAL INCOME TAX

PROCESSING CENTER

When do I file?

PO BOX 4124

You must pay the amount you owe by April 15, 2013, to avoid

BINGHAMTON NY 13902-4124

interest and penalties.

Private delivery services

If you choose, you may use a private delivery service, instead of

How do I prepare my payment?

the U.S. Postal Service, to mail in your form and tax payment.

Make your check or money order payable to New York State

However, if, at a later date, you need to establish the date you

Income Tax for the full amount you owe and write your social

filed or paid your tax, you cannot use the date recorded by a

security number and 2012 Income Tax on it.

private delivery service unless you used a delivery service that

has been designated by the U.S. Secretary of the Treasury

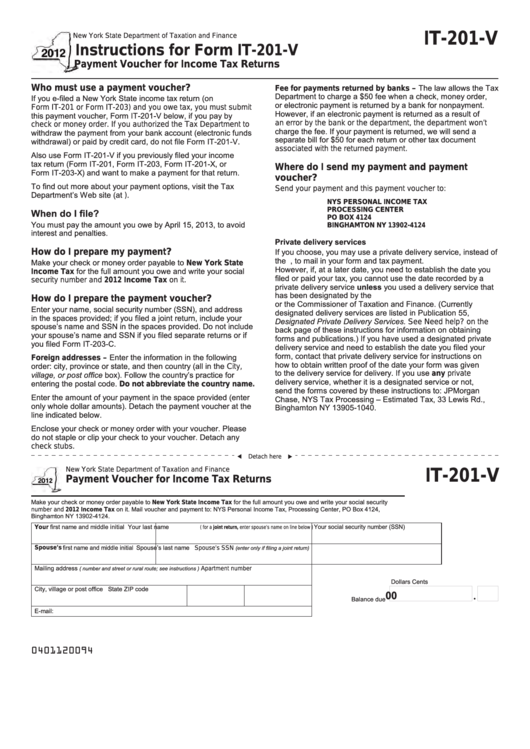

How do I prepare the payment voucher?

or the Commissioner of Taxation and Finance. (Currently

Enter your name, social security number (SSN), and address

designated delivery services are listed in Publication 55,

in the spaces provided; if you filed a joint return, include your

Designated Private Delivery Services. See Need help? on the

spouse’s name and SSN in the spaces provided. Do not include

back page of these instructions for information on obtaining

your spouse’s name and SSN if you filed separate returns or if

forms and publications.) If you have used a designated private

you filed Form IT-203-C.

delivery service and need to establish the date you filed your

form, contact that private delivery service for instructions on

Foreign addresses – Enter the information in the following

how to obtain written proof of the date your form was given

order: city, province or state, and then country (all in the City,

to the delivery service for delivery. If you use any private

village, or post office box). Follow the country’s practice for

delivery service, whether it is a designated service or not,

entering the postal code. Do not abbreviate the country name.

send the forms covered by these instructions to: JPMorgan

Enter the amount of your payment in the space provided (enter

Chase, NYS Tax Processing – Estimated Tax, 33 Lewis Rd.,

only whole dollar amounts). Detach the payment voucher at the

Binghamton NY 13905-1040.

line indicated below.

Enclose your check or money order with your voucher. Please

do not staple or clip your check to your voucher. Detach any

check stubs.

Detach here

New York State Department of Taxation and Finance

IT-201-V

Payment Voucher for Income Tax Returns

Make your check or money order payable to New York State Income Tax for the full amount you owe and write your social security

number and 2012 Income Tax on it. Mail voucher and payment to: NYS Personal Income Tax, Processing Center, PO Box 4124,

Binghamton NY 13902-4124.

Your first name and middle initial

Your last name

Your social security number (SSN)

( for a joint return, enter spouse’s name on line below )

Spouse’s first name and middle initial

Spouse’s last name

(enter only if filing a joint return)

Spouse’s SSN

Mailing address

( number and street or rural route; see instructions )

Apartment number

Dollars

Cents

City, village or post office

State

ZIP code

00

Balance due

E-mail:

0401120094

1

1 2

2