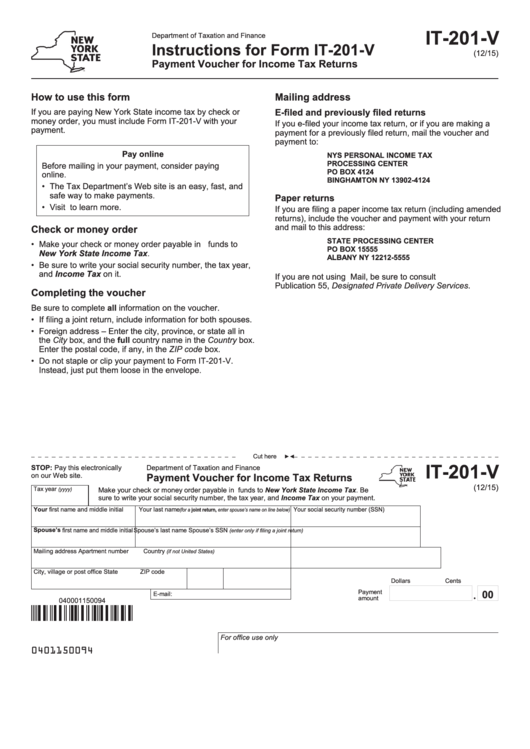

IT-201-V

Department of Taxation and Finance

Instructions for Form IT-201-V

(12/15)

Payment Voucher for Income Tax Returns

How to use this form

Mailing address

If you are paying New York State income tax by check or

E-filed and previously filed returns

money order, you must include Form IT-201-V with your

If you e-filed your income tax return, or if you are making a

payment.

payment for a previously filed return, mail the voucher and

payment to:

Pay online

NYS PERSONAL INCOME TAX

PROCESSING CENTER

Before mailing in your payment, consider paying

PO BOX 4124

online.

BINGHAMTON NY 13902-4124

• The Tax Department’s Web site is an easy, fast, and

safe way to make payments.

Paper returns

• Visit to learn more.

If you are filing a paper income tax return (including amended

returns), include the voucher and payment with your return

and mail to this address:

Check or money order

STATE PROCESSING CENTER

• Make your check or money order payable in U.S. funds to

PO BOX 15555

New York State Income Tax.

ALBANY NY 12212-5555

• Be sure to write your social security number, the tax year,

and Income Tax on it.

If you are not using U.S. Mail, be sure to consult

Publication 55, Designated Private Delivery Services.

Completing the voucher

Be sure to complete all information on the voucher.

• If filing a joint return, include information for both spouses.

• Foreign address – Enter the city, province, or state all in

the City box, and the full country name in the Country box.

Enter the postal code, if any, in the ZIP code box.

• Do not staple or clip your payment to Form IT-201-V.

Instead, just put them loose in the envelope.

◄

Cut here

►

IT-201-V

STOP: Pay this electronically

Department of Taxation and Finance

on our Web site.

Payment Voucher for Income Tax Returns

(12/15)

Tax year

Make your check or money order payable in U.S. funds to New York State Income Tax. Be

(yyyy)

sure to write your social security number, the tax year, and Income Tax on your payment.

Your first name and middle initial

Your last name

Your social security number (SSN)

(for a joint return, enter spouse’s name on line below)

Spouse’s first name and middle initial Spouse’s last name

Spouse’s SSN

(enter only if filing a joint return)

Mailing address

Apartment number

Country

(if not United States)

City, village or post office

State

ZIP code

Dollars

Cents

00

Payment

E-mail:

amount

040001150094

For office use only

0401150094

1

1 2

2