Form Ct-187 - Election Or Revocation Of Election By Railroad And Trucking Corporations

ADVERTISEMENT

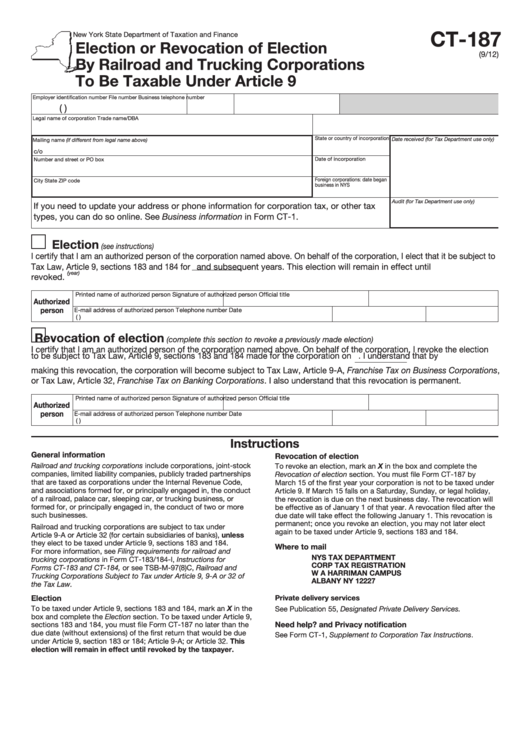

CT-187

New York State Department of Taxation and Finance

Election or Revocation of Election

(9/12)

By Railroad and Trucking Corporations

To Be Taxable Under Article 9

Employer identification number

File number

Business telephone number

(

)

Legal name of corporation

Trade name/DBA

State or country of incorporation

Date received (for Tax Department use only)

Mailing name (if different from legal name above)

c/o

Date of incorporation

Number and street or PO box

Foreign corporations: date began

City

State

ZIP code

business in NYS

Audit (for Tax Department use only)

If you need to update your address or phone information for corporation tax, or other tax

types, you can do so online. See Business information in Form CT-1.

Election

(see instructions)

I certify that I am an authorized person of the corporation named above. On behalf of the corporation, I elect that it be subject to

Tax Law, Article 9, sections 183 and 184 for

and subsequent years. This election will remain in effect until

(year)

revoked.

Printed name of authorized person

Signature of authorized person

Official title

Authorized

person

E-mail address of authorized person

Telephone number

Date

(

)

Revocation of election

(complete this section to revoke a previously made election)

I certify that I am an authorized person of the corporation named above. On behalf of the corporation, I revoke the election

to be subject to Tax Law, Article 9, sections 183 and 184 made for the corporation on

. I understand that by

making this revocation, the corporation will become subject to Tax Law, Article 9-A, Franchise Tax on Business Corporations,

or Tax Law, Article 32, Franchise Tax on Banking Corporations. I also understand that this revocation is permanent.

Printed name of authorized person

Signature of authorized person

Official title

Authorized

person

E-mail address of authorized person

Telephone number

Date

(

)

Instructions

General information

Revocation of election

Railroad and trucking corporations include corporations, joint-stock

To revoke an election, mark an X in the box and complete the

companies, limited liability companies, publicly traded partnerships

Revocation of election section. You must file Form CT-187 by

that are taxed as corporations under the Internal Revenue Code,

March 15 of the first year your corporation is not to be taxed under

and associations formed for, or principally engaged in, the conduct

Article 9. If March 15 falls on a Saturday, Sunday, or legal holiday,

of a railroad, palace car, sleeping car, or trucking business, or

the revocation is due on the next business day. The revocation will

formed for, or principally engaged in, the conduct of two or more

be effective as of January 1 of that year. A revocation filed after the

such businesses.

due date will take effect the following January 1. This revocation is

permanent; once you revoke an election, you may not later elect

Railroad and trucking corporations are subject to tax under

again to be taxed under Article 9, sections 183 and 184.

Article 9-A or Article 32 (for certain subsidiaries of banks), unless

they elect to be taxed under Article 9, sections 183 and 184.

Where to mail

For more information, see Filing requirements for railroad and

NYS TAX DEPARTMENT

trucking corporations in Form CT-183/184-I, Instructions for

CORP TAX REGISTRATION

Forms CT-183 and CT-184, or see TSB-M-97(8)C, Railroad and

W A HARRIMAN CAMPUS

Trucking Corporations Subject to Tax under Article 9, 9-A or 32 of

ALBANY NY 12227

the Tax Law.

Election

Private delivery services

To be taxed under Article 9, sections 183 and 184, mark an X in the

See Publication 55, Designated Private Delivery Services.

box and complete the Election section. To be taxed under Article 9,

Need help? and Privacy notification

sections 183 and 184, you must file Form CT-187 no later than the

due date (without extensions) of the first return that would be due

See Form CT-1, Supplement to Corporation Tax Instructions.

under Article 9, section 183 or 184; Article 9-A; or Article 32. This

election will remain in effect until revoked by the taxpayer.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1