Instructions For Form L-176

ADVERTISEMENT

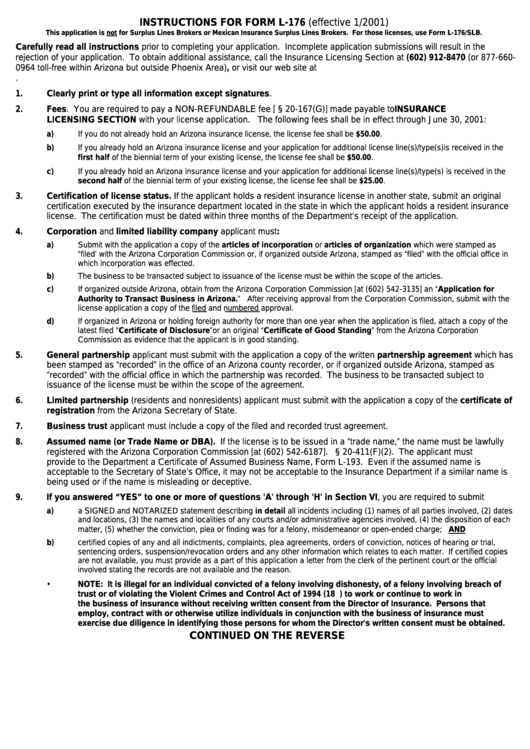

INSTRUCTIONS FOR FORM L-176 (effective 1/2001)

This application is not for Surplus Lines Brokers or Mexican Insurance Surplus Lines Brokers. For those licenses, use Form L-176/SLB.

Carefully read all instructions prior to completing your application. Incomplete application submissions will result in the

rejection of your application. To obtain additional assistance, call the Insurance Licensing Section at (602) 912-8470 (or 877-660-

0964 toll-free within Arizona but outside Phoenix Area), or visit our web site at

1.

Clearly print or type all information except signatures.

2.

Fees. You are required to pay a NON-REFUNDABLE fee [A.R.S. § 20-167(G)] made payable to INSURANCE

LICENSING SECTION with your license application. The following fees shall be in effect through June 30, 2001:

a)

If you do not already hold an Arizona insurance license, the license fee shall be $50.00.

b)

If you already hold an Arizona insurance license and your application for additional license line(s)/type(s)is received in the

first half of the biennial term of your existing license, the license fee shall be $50.00.

c)

If you already hold an Arizona insurance license and your application for additional license line(s)/type(s) is received in the

second half of the biennial term of your existing license, the license fee shall be $25.00.

3.

Certification of license status. If the applicant holds a resident insurance license in another state, submit an original

certification executed by the insurance department located in the state in which the applicant holds a resident insurance

license. The certification must be dated within three months of the Department’s receipt of the application.

4.

Corporation and limited liability company applicant must:

a)

Submit with the application a copy of the articles of incorporation or articles of organization which were stamped as

“filed’ with the Arizona Corporation Commission or, if organized outside Arizona, stamped as “filed” with the official office in

which incorporation was effected.

b)

The business to be transacted subject to issuance of the license must be within the scope of the articles.

c)

If organized outside Arizona, obtain from the Arizona Corporation Commission [at (602) 542-3135] an “Application for

Authority to Transact Business in Arizona.” After receiving approval from the Corporation Commission, submit with the

license application a copy of the filed and numbered approval.

d)

If organized in Arizona or holding foreign authority for more than one year when the application is filed, attach a copy of the

latest filed “Certificate of Disclosure” or an original “Certificate of Good Standing” from the Arizona Corporation

Commission as evidence that the applicant is in good standing.

5.

General partnership applicant must submit with the application a copy of the written partnership agreement which has

been stamped as “recorded” in the office of an Arizona county recorder, or if organized outside Arizona, stamped as

“recorded” with the official office in which the partnership was recorded. The business to be transacted subject to

issuance of the license must be within the scope of the agreement.

6.

Limited partnership (residents and nonresidents) applicant must submit with the application a copy of the certificate of

registration from the Arizona Secretary of State.

7.

Business trust applicant must include a copy of the filed and recorded trust agreement.

8.

Assumed name (or Trade Name or DBA). If the license is to be issued in a “trade name,” the name must be lawfully

registered with the Arizona Corporation Commission [at (602) 542-6187]. A.R.S. § 20-411(F)(2). The applicant must

provide to the Department a Certificate of Assumed Business Name, Form L-193. Even if the assumed name is

acceptable to the Secretary of State’s Office, it may not be acceptable to the Insurance Department if a similar name is

being used or if the name is misleading or deceptive.

9.

If you answered “YES” to one or more of questions 'A' through 'H' in Section VI, you are required to submit

a)

a SIGNED and NOTARIZED statement describing in detail all incidents including (1) names of all parties involved, (2) dates

and locations, (3) the names and localities of any courts and/or administrative agencies involved, (4) the disposition of each

matter, (5) whether the conviction, plea or finding was for a felony, misdemeanor or open-ended charge; AND

b)

certified copies of any and all indictments, complaints, plea agreements, orders of conviction, notices of hearing or trial,

sentencing orders, suspension/revocation orders and any other information which relates to each matter. If certified copies

are not available, you must provide as a part of this application a letter from the clerk of the pertinent court or the official

involved stating the records are not available and the reason.

•

NOTE: It is illegal for an individual convicted of a felony involving dishonesty, of a felony involving breach of

trust or of violating the Violent Crimes and Control Act of 1994 (18 U.S.C. 1033) to work or continue to work in

the business of insurance without receiving written consent from the Director of Insurance. Persons that

employ, contract with or otherwise utilize individuals in conjunction with the business of insurance must

exercise due diligence in identifying those persons for whom the Director's written consent must be obtained.

CONTINUED ON THE REVERSE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2