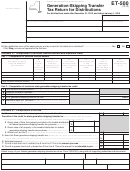

Form Et-500 - Generation-Skipping Transfer Tax Return For Distributions - 2012 Page 2

ADVERTISEMENT

ET-500 (2012) (back)

(continued)

Instructions

Extensions of time to file

trade, business, or occupation in New York State, that was transferred

by the original transferor. New York property also includes all intangible

If you know that you cannot meet the filing deadline, request an

personal property transferred by the original transferor, if the transferor

extension of time to file by writing to the following address:

was a resident of New York State at the time of the transfer of the

NYS TAX DEPARTMENT

property to the trust.

ESTATE TAX PROCESSING

Line 3 – If an entry was made on line 2, enter the value (on the date of

W A HARRIMAN CAMPUS

distribution) of all property included in the generation‑skipping transfer

ALBANY NY 12227

from the trust to the skip person distributee, including the value of the

The time to file will be automatically extended six months if the letter is

New York property.

sent by April 15. Note: Filing a request for an extension of time to file

does not extend the time for payment of tax. See Payment of tax on the

Line 6 – Enter the amount of any estimated payments.

front page.

Paid preparer’s responsibilities

Where to file

Under the law, all paid preparers must sign and complete the paid

Mail this form and payment to:

preparer section of the return. Paid preparers may be subject to civil

and/or criminal sanctions if they fail to complete this section in full.

NYS GENERATION-SKIPPING TRANSFER TAX

PROCESSING CENTER

When completing this section, you must enter your New York tax

PO BOX 15167

preparer registration identification number (NYTPRIN) if you are

ALBANY NY 12212-5167

required to have one. Also, you must enter your federal preparer tax

identification number (PTIN) if you have one; if not, you must enter your

Private delivery services

social security number.

If you choose, you may use a private delivery service, instead of the

U.S. Postal Service, to mail in your form and tax payment. However,

Privacy notification

if, at a later date, you need to establish the date you filed or paid your

The Commissioner of Taxation and Finance may collect and maintain

tax, you cannot use the date recorded by a private delivery service

personal information pursuant to the New York State Tax Law, including

unless you used a delivery service that has been designated by

but not limited to, sections 5‑a, 171, 171‑a, 287, 308, 429, 475, 505,

the U.S. Secretary of the Treasury or the Commissioner of Taxation

697, 1096, 1142, and 1415 of that Law; and may require disclosure of

and Finance. (Currently designated delivery services are listed in

social security numbers pursuant to 42 USC 405(c)(2)(C)(i).

Publication 55, Designated Private Delivery Services. See Need

help? below for information on obtaining forms and publications.)

This information will be used to determine and administer tax liabilities

If you have used a designated private delivery service and need to

and, when authorized by law, for certain tax offset and exchange of tax

establish the date you filed your form, contact that private delivery

information programs as well as for any other lawful purpose.

service for instructions on how to obtain written proof of the date your

form was given to the delivery service for delivery. If you use any

Information concerning quarterly wages paid to employees is provided

private delivery service, whether it is a designated service or not, send

to certain state agencies for purposes of fraud prevention, support

the forms covered by these instructions to: State Processing Center,

enforcement, evaluation of the effectiveness of certain employment and

431C Broadway, Albany NY 12204‑4836.

training programs and other purposes authorized by law.

Failure to provide the required information may subject you to civil or

Specific instructions

criminal penalties, or both, under the Tax Law.

You must submit a completed federal Form 706‑GS(D), including all

This information is maintained by the Manager of Document

schedules and documents, with your Form ET‑500.

Management, NYS Tax Department, W A Harriman Campus, Albany NY

12227; telephone (518) 457‑5181.

When calculating the inclusion ratio, it is necessary to do a separate

calculation for the New York State GST tax because it does not conform

to the federal GST exemption amounts for transfers made to a trust

Need help?

after 2003. The trustee must supply the distributee with the calculation

of the inclusion ratio that was used to determine the taxable amount for

Visit our Web site at

each distribution from the trust to the skip person distributee.

• get information and manage your taxes online

For 2012 distributions, in place of the federal exemption amount, use

• check for new online services and features

$1,390,000 as the New York State numerator limit when recalculating

the inclusion ratio.

Telephone assistance

The distributee must attach a schedule showing how the taxable

(518) 457‑5387

Estate Tax Information Center:

amount for New York State was computed.

To order forms and publications:

(518) 457‑5431

Name of the skip person distributee

Text Telephone (TTY) Hotline (for persons with

• Individual: Enter last name, first name, middle initial, and SSN.

hearing and speech disabilities using a TTY): (518) 485‑5082

• Trust: Enter the name of the trust and EIN.

Persons with disabilities: In compliance with the

Line 1 – In the first box, enter the total of the taxable amounts of

Americans with Disabilities Act, we will ensure that our

the taxable distributions from the trust to the skip person distributee

lobbies, offices, meeting rooms, and other facilities are

that occurred at the same time as, and as a result of, the death of an

accessible to persons with disabilities. If you have questions about

individual. Multiply this amount by the factor of .0275 and enter the

special accommodations for persons with disabilities, call the

result in the second box. If the taxable distribution from the trust is

information center.

wholly from New York property (see definition below), skip lines 2, 3,

and 4 and enter the amount from line 1 on line 5.

Line 2 – If the taxable distribution from the trust included non‑New York

property, enter the value (on the date of distribution) of the New York

property included in the distribution.

The term New York property includes real property and tangible

personal property having a physical location in New York State and

intangible personal property within the state employed in carrying on a

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2