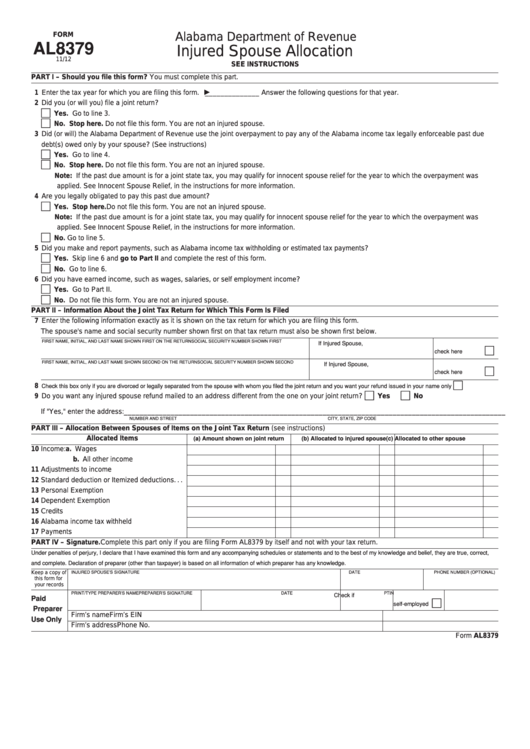

FORM

Alabama Department of Revenue

AL8379

Injured Spouse Allocation

Reset Form

11/12

SEE INSTRUCTIONS

PART I – Should you file this form? You must complete this part.

1 Enter the tax year for which you are filing this form.

______________ Answer the following questions for that year.

2 Did you (or will you) file a joint return?

Yes. Go to line 3.

No. Stop here. Do not file this form. You are not an injured spouse.

3 Did (or will) the Alabama Department of Revenue use the joint overpayment to pay any of the Alabama income tax legally enforceable past due

debt(s) owed only by your spouse? (See instructions)

Yes. Go to line 4.

No. Stop here. Do not file this form. You are not an injured spouse.

Note: If the past due amount is for a joint state tax, you may qualify for innocent spouse relief for the year to which the overpayment was

applied. See Innocent Spouse Relief, in the instructions for more information.

4 Are you legally obligated to pay this past due amount?

Yes. Stop here. Do not file this form. You are not an injured spouse.

Note: If the past due amount is for a joint state tax, you may qualify for innocent spouse relief for the year to which the overpayment was

applied. See Innocent Spouse Relief, in the instructions for more information.

No. Go to line 5.

5 Did you make and report payments, such as Alabama income tax withholding or estimated tax payments?

Yes. Skip line 6 and go to Part II and complete the rest of this form.

No. Go to line 6.

6 Did you have earned income, such as wages, salaries, or self employment income?

Yes. Go to Part II.

No. Do not file this form. You are not an injured spouse.

PART II – Information About the Joint Tax Return for Which This Form Is Filed

7 Enter the following information exactly as it is shown on the tax return for which you are filing this form.

The spouse's name and social security number shown first on that tax return must also be shown first below.

FIRST NAME, INITIAL, AND LAST NAME SHOWN FIRST ON THE RETURN

SOCIAL SECURITY NUMBER SHOWN FIRST

If Injured Spouse,

check here

FIRST NAME, INITIAL, AND LAST NAME SHOWN SECOND ON THE RETURN

SOCIAL SECURITY NUMBER SHOWN SECOND

If Injured Spouse,

check here

8 Check this box only if you are divorced or legally separated from the spouse with whom you filed the joint return and you want your refund issued in your name only . . . . . . . . . .

9 Do you want any injured spouse refund mailed to an address different from the one on your joint return? . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

If "Yes," enter the address: __________________________________________________________________________________________________

NUMBER AND STREET

CITY, STATE, ZIP CODE

PART III – Allocation Between Spouses of Items on the Joint Tax Return (see instructions)

Allocated Items

(a) Amount shown on joint return

(b) Allocated to injured spouse

(c) Allocated to other spouse

10 Income: a. Wages. . . . . . . . . . . . . . . . . . . . . . . . .

b. All other income . . . . . . . . . . . . . . . .

11 Adjustments to income . . . . . . . . . . . . . . . . . . . . . .

12 Standard deduction or Itemized deductions . . .

13 Personal Exemption. . . . . . . . . . . . . . . . . . . . . . . . .

14 Dependent Exemption. . . . . . . . . . . . . . . . . . . . . . .

15 Credits. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16 Alabama income tax withheld . . . . . . . . . . . . . . . .

17 Payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

PART IV – Signature. Complete this part only if you are filing Form AL8379 by itself and not with your tax return.

Under penalties of perjury, I declare that I have examined this form and any accompanying schedules or statements and to the best of my knowledge and belief, they are true, correct,

and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

INJURED SPOUSE’S SIGNATURE

DATE

PHONE NUMBER (OPTIONAL)

Keep a copy of

this form for

your records

PRINT/TYPE PREPARER’S NAME

PREPARER’S SIGNATURE

DATE

PTIN

Check if

Paid

self-employed

Preparer

Firm’s name

Firm’s EIN

Use Only

Firm’s address

Phone No.

Form AL8379

1

1