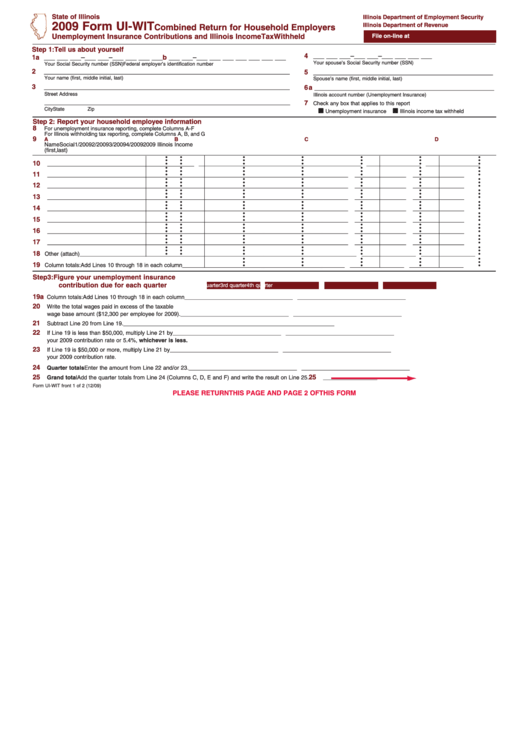

State of Illinois

Illinois Department of Employment Security

2009 Form UI-WIT

Illinois Department of Revenue

Combined Return for Household Employers

File on-line at household.illinois.gov

Unemployment Insurance Contributions and Illinois Income Tax Withheld

Step 1: Tell us about yourself

4

___ ___ ___–___ ___–___ ___ ___ ___

1a

___ ___ ___–___ ___–___ ___ ___ ___

b

___ ___–___ ___ ___ ___ ___ ___ ___

Your spouse’s Social Security number (SSN)

Your Social Security number (SSN)

Federal employer’s identification number

2

___________________________________________________________________

5

_________________________________________________

Your name (first, middle initial, last)

Spouse’s name (first, middle initial, last)

3

___________________________________________________________________

6 a

_________________________________________________

Street Address

Illinois account number (Unemployment Insurance)

___________________________________________________________________

7

Check any box that applies to this report

City

State

Zip

I I

I I

Unemployment insurance

Illinois income tax withheld

Step 2: Report your household employee information

8

For unemployment insurance reporting, complete Columns A-F

For Illinois withholding tax reporting, complete Columns A, B, and G

9

A

B

C

D

E

F

G

Name

Social

1/2009

2/2009

3/2009

4/2009

2009 Illinois Income

(first, last)

Security no.

QTR. ending Mar. 31 QTR. ending June 30 QTR. ending Sept. 30 QTR. ending Dec. 31

Tax Withheld

•

•

•

•

•

•

•

•

•

•

•

•

•

•

10

__________________________ ______________

__________________ __________________ __________________ __________________ __________________

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

11

__________________________ ______________ ______________ ______________

______________ ______________ ______________

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

12

__________________________ ______________ ______________ ______________

______________ ______________ ______________

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

13

__________________________ ______________ ______________ ______________

______________ ______________ ______________

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

14

__________________________ ______________ ______________ ______________

______________ ______________ ______________

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

15

__________________________ ______________ ______________ ______________

______________ ______________ ______________

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

16

__________________________ ______________ ______________ ______________

______________ ______________ ______________

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

17

__________________________ ______________ ______________ ______________

______________ ______________ ______________

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

18

Other (attach)

____________________ __________________ __________________ __________________ __________________ __________________ __________________

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

19

Column totals: Add Lines 10 through 18 in each column

__________________ __________________ __________________ __________________ __________________

•

•

•

•

•

Step 3: Figure your unemployment insurance

contribution due for each quarter

1st quarter

2nd quarter

3rd quarter

4th quarter

19a

Column totals: Add Lines 10 through 18 in each column

__________________ __________________ __________________

__________________

20

Write the total wages paid in excess of the taxable

wage base amount ($12,300 per employee for 2009).

__________________ __________________ __________________

__________________

21

Subtract Line 20 from Line 19.

_________________ _________________ _________________ _________________

22

If Line 19 is less than $50,000, multiply Line 21 by

__________________ __________________ __________________

__________________

your 2009 contribution rate or 5.4%, whichever is less.

23

If Line 19 is $50,000 or more, multiply Line 21 by

__________________ __________________ __________________

__________________

your 2009 contribution rate.

24

Quarter totals Enter the amount from Line 22 and/or 23.

__________________ __________________ __________________

__________________

25

25

Grand total Add the quarter totals from Line 24 (Columns C, D, E and F) and write the result on Line 25.

__________________

Form UI-WIT front 1 of 2 (12/09)

PLEASE RETURN THIS PAGE AND PAGE 2 OF THIS FORM

1

1 2

2