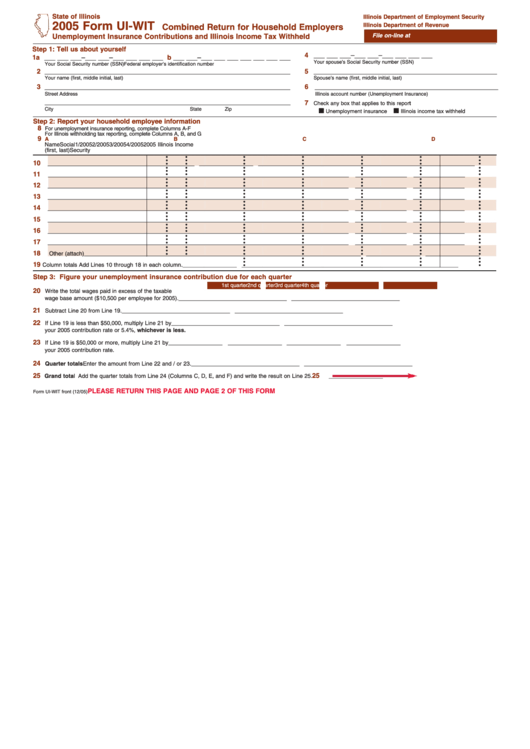

State of Illinois

Illinois Department of Employment Security

2005 Form UI-WIT

Illinois Department of Revenue

Combined Return for Household Employers

Unemployment Insurance Contributions and Illinois Income Tax Withheld

File on-line at household.illinois.gov

Step 1: Tell us about yourself

4

___ ___ ___–___ ___–___ ___ ___ ___

1a

___ ___ ___–___ ___–___ ___ ___ ___

b

___ ___–___ ___ ___ ___ ___ ___ ___

Your spouse’s Social Security number (SSN)

Your Social Security number (SSN)

Federal employer’s identification number

2

___________________________________________________________________

5

__________________________________________________

Your name (first, middle initial, last)

Spouse’s name (first, middle initial, last)

3

___________________________________________________________________

6

a

__________________________________________________

Street Address

Illinois account number (Unemployment Insurance)

___________________________________________________________________

7

Check any box that applies to this report

I I

I I

City

State

Zip

Unemployment insurance

Illinois income tax withheld

Step 2: Report your household employee information

8

For unemployment insurance reporting, complete Columns A-F

For Illinois withholding tax reporting, complete Columns A, B, and G

9

A

B

C

D

E

F

G

Name

Social

1/2005

2/2005

3/2005

4/2005

2005 Illinois Income

(first, last)

Security no.

QTR. ending Mar. 31 QTR. ending June 30 QTR. ending Sept. 30 QTR. ending Dec. 31

Tax Withheld

•

•

•

•

•

•

•

•

•

•

•

•

•

•

10

__________________________ ______________

__________________ __________________ __________________ __________________ __________________

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

11

__________________________ ______________ ______________ ______________

______________ ______________ ______________

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

12

__________________________ ______________ ______________ ______________

______________ ______________ ______________

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

13

__________________________ ______________ ______________ ______________

______________ ______________ ______________

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

14

__________________________ ______________ ______________ ______________

______________ ______________ ______________

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

15

__________________________ ______________ ______________ ______________

______________ ______________ ______________

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

16

__________________________ ______________ ______________ ______________

______________ ______________ ______________

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

17

__________________________ ______________ ______________ ______________

______________ ______________ ______________

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

18

Other (attach)

____________________ __________________ __________________ __________________ __________________ __________________ __________________

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

19

Column totals Add Lines 10 through 18 in each column.

__________________ __________________ __________________ __________________

__________________

•

•

•

•

•

Step 3: Figure your unemployment insurance contribution due for each quarter

1st quarter

2nd quarter

3rd quarter

4th quarter

20

Write the total wages paid in excess of the taxable

wage base amount ($10,500 per employee for 2005).

__________________ __________________ __________________

__________________

21

Subtract Line 20 from Line 19.

__________________ __________________ __________________

__________________

22

If Line 19 is less than $50,000, multiply Line 21 by

__________________ __________________ __________________

__________________

your 2005 contribution rate or 5.4%, whichever is less.

23

If Line 19 is $50,000 or more, multiply Line 21 by

__________________ __________________ __________________

__________________

your 2005 contribution rate.

24

Quarter totals Enter the amount from Line 22 and / or 23.

__________________ __________________ __________________

__________________

25

25

Grand total Add the quarter totals from Line 24 (Columns C, D, E, and F) and write the result on Line 25.

__________________

PLEASE RETURN THIS PAGE AND PAGE 2 OF THIS FORM

Form UI-WIT front (12/05)

1

1 2

2