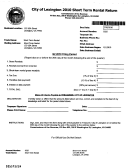

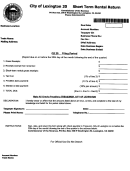

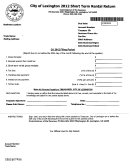

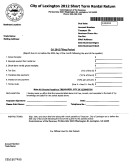

Form Return Of Short-Term Rental Property - City Of Falls Church

ADVERTISEMENT

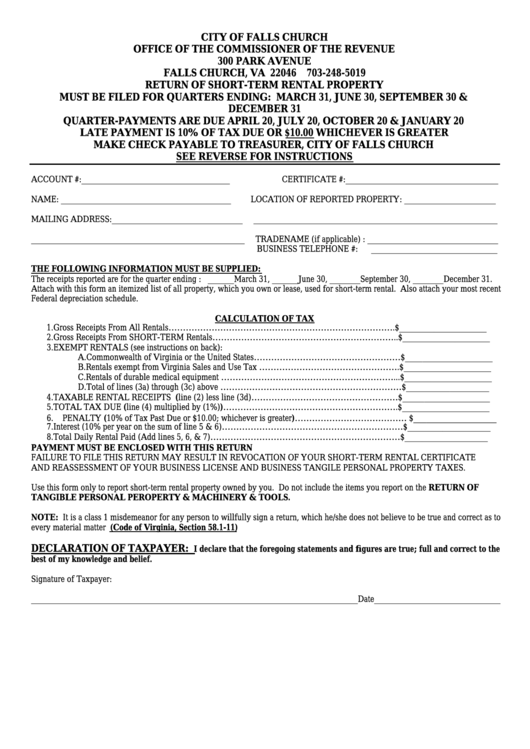

CITY OF FALLS CHURCH

OFFICE OF THE COMMISSIONER OF THE REVENUE

300 PARK AVENUE

FALLS CHURCH, VA 22046 703-248-5019

RETURN OF SHORT-TERM RENTAL PROPERTY

MUST BE FILED FOR QUARTERS ENDING: MARCH 31, JUNE 30, SEPTEMBER 30 &

DECEMBER 31

QUARTER-PAYMENTS ARE DUE APRIL 20, JULY 20, OCTOBER 20 & JANUARY 20

LATE PAYMENT IS 10% OF TAX DUE OR $10.00 WHICHEVER IS GREATER

MAKE CHECK PAYABLE TO TREASURER, CITY OF FALLS CHURCH

SEE REVERSE FOR INSTRUCTIONS

ACCOUNT #:__________________________________

CERTIFICATE #:___________________________________

NAME: _______________________________________

LOCATION OF REPORTED PROPERTY: _____________________

MAILING ADDRESS:______________________________

________________________________________________________

_________________________________________________

TRADENAME (if applicable) : ______________________________

BUSINESS TELEPHONE #:

_____________________________

THE FOLLOWING INFORMATION MUST BE SUPPLIED:

The receipts reported are for the quarter ending : ______March 31, ______June 30, _______September 30, _______December 31.

Attach with this form an itemized list of all property, which you own or lease, used for short-term rental. Also attach your most recent

Federal depreciation schedule.

CALCULATION OF TAX

1. Gross Receipts From All Rentals…………………………………………………………………….$____________________

2. Gross Receipts From SHORT-TERM Rentals………………………………………………………..$____________________

3. EXEMPT RENTALS (see instructions on back):

A. Commonwealth of Virginia or the United States……………………………………………$____________________

B. Rentals exempt from Virginia Sales and Use Tax ………………………………………….$____________________

C. Rentals of durable medical equipment ……………………………………………………...$____________________

D. Total of lines (3a) through (3c) above ………………………………………………………$___________________

4. TAXABLE RENTAL RECEIPTS (line (2) less line (3d)……………………………………………$____________________

5. TOTAL TAX DUE (line (4) multiplied by (1%))…………………………………………………….$____________________

6. PENALTY (10% of Tax Past Due or $10.00; whichever is greater)………………………………… $___________________

7. Interest (10% per year on the sum of line 5 & 6)………………………………………………………$___________________

8. Total Daily Rental Paid (Add lines 5, 6, & 7)…………………………………………………………$___________________

PAYMENT MUST BE ENCLOSED WITH THIS RETURN

FAILURE TO FILE THIS RETURN MAY RESULT IN REVOCATION OF YOUR SHORT-TERM RENTAL CERTIFICATE

AND REASSESSMENT OF YOUR BUSINESS LICENSE AND BUSINESS TANGILE PERSONAL PROPERTY TAXES.

Use this form only to report short-term rental property owned by you. Do not include the items you report on the RETURN OF

TANGIBLE PERSONAL PEROPERTY & MACHINERY & TOOLS.

NOTE: It is a class 1 misdemeanor for any person to willfully sign a return, which he/she does not believe to be true and correct as to

every material matter (Code of Virginia, Section 58.1-11)

DECLARATION OF TAXPAYER:

I declare that the foregoing statements and figures are true; full and correct to the

best of my knowledge and belief.

Signature of Taxpayer:

___________________________________________________________________________Date_____________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2