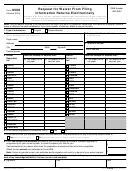

Form Ct-8508 - Request For Waiver From Filing Informational Returns Electronically Page 2

ADVERTISEMENT

Form CT-8508 Instructions

General Instructions

Line 7: Complete columns (a), (b), and (c) for each return (W-2,

W-2G, 1099-R, or 1099-MISC) this waiver is filed for.

DRS will notify you only if your request is denied.

Column (a): For each return type enter an estimate of the number

Use Form CT-8508, Request for Waiver From Filing Informational

of returns you are requesting a waiver for.

Returns Electronically, to request a waiver from filing Forms W-2,

W-2G, 1099-R, or 1099-MISC electronically for the current calendar

Column (b): For each return type enter the number of returns you

year.

expect to file with Connecticut.

Complete a separate Form CT-8508 for each Connecticut Tax

Column (c): For each return type enter an estimate of the number

Registration Number. Form CT-8508 may be used for multiple

of returns you expect to file with Connecticut for the following

form types.

calendar year.

Due Date: Form CT-8508 is due on or before January 15, 2012. If

Line 8: For the current calendar year:

the due date falls on a Saturday, Sunday, or legal holiday, the next

Check if you have applied or have not applied for a waiver from

business day is the due date.

the Internal Revenue Service (IRS). If Yes, attach a copy of federal

If a waiver is granted, you must submit informational returns

Form 8508, Request for Waiver From Filing Information Returns

on Compact Disc (CD). See Informational Publication

Electronically.

2011(11), Forms 1099-R, 1099-MISC, and W-2G Electronic

If a waiver request was filed with the IRS, check if the waiver was

Filing Requirements for Tax Year 2011, or Informational

approved (Yes), denied (No), or the request is still (Pending). If

Publication 2011(12), Form W-2 Electronic Filing Requirements

Yes, attach a copy of the approval.

for Tax Year 2011.

Line 9: If this is the first time you have requested a waiver for

Electronic Filing Requirements

any calendar year, check Yes and skip to Declaration. If you have

Taxpayers who file 25 or more Forms W-2, W-2G, 1099-R, or

requested a waiver in the past, check No and complete Line 10.

1099-MISC, per form type, are required to file through the

Line 10: Give a brief description of the hardship electronic filing

Department of Revenue Services (DRS) Taxpayer Service Center

would cause.

(TSC).

Declaration

Taxpayers who file 24 or fewer Forms W-2, W-2G, 1099-R, or

The waiver request must be signed by the filer or a person duly

1099-MISC, per form type, are encouraged to file electronically

authorized to sign a return or other document on the filer’s

but may use paper forms without requesting a waiver.

behalf. If you are filing on a filer’s behalf complete and attach

Line Instructions

Form LGL-001, Power of Attorney.

Line 1: Check the appropriate box. An original submission is

Mail to: Department of Revenue Services

your first request for a waiver for the current calendar year. A

State of Connecticut

reconsideration indicates you are submitting additional information

PO Box 2930

you believe may persuade DRS to approve a previously denied

Hartford CT 06104-2930

request.

Taxpayer Service Center

Line 2: Enter the calendar year you are requesting a waiver for.

Use the TSC at for the fastest and easiest way

Only current calendar year waiver requests can be processed. If

to update your tax information, file returns, and remit payments.

this block is not completed, DRS will assume the request is for the

current calendar year.

For More Information

Line 3: Enter filer’s Connecticut Tax Registration Number.

Call DRS during business hours, Monday through Friday:

Line 4: Enter filer’s Federal Employer Identification Number

•

1-800-382-9463 (Connecticut calls outside the Greater Hartford

(FEIN).

calling area only); or

Line 5: Enter filer’s complete name and mailing address. For street

•

860-297-5962 (from anywhere).

address include room or suite number.

TTY, TDD, and Text Telephone users only may transmit inquiries

Line 6: Enter name and telephone number of contact person.

anytime by calling 860-297-4911.

Forms and Publications

Visit the DRS website at to download and print

Connecticut tax forms.

Form CT-8508 Back (Rev. 01/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2