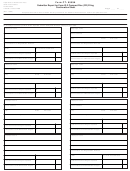

Form Ct-6559 - Submitter Report For Form W-2 Compact Disc (Cd) Filing Page 2

ADVERTISEMENT

Form CT-6559 Instructions

General Instructions

CD Specifications

Complete this form in blue or black ink only.

• Data must be saved using the ASCII character set;

Use Form CT-6559, Submitter Report for Form W-2 Compact

• Each record must be 512 characters in length; and

Disc (CD) Filing, to submit Forms W-2 on CD to the Department

• File names must end with file extension .txt or .dat.

of Revenue Services (DRS).

Report state wages (box 16) in Code RS record location 276-286.

Attach Form CT-W3, Connecticut Annual Reconciliation of

Report state income tax (box 17) in Code RS record location

Withholding, for each employer submitted with this form.

287-297.

Line Instructions

All files must begin with a code RA submitter record and end with

Line 1: Check if CD is an original or replacement file.

a code RF submitter record. See Informational Publication

Line 2: Enter calendar year reported on CD. Report one calendar

2011(12), Form W-2 Electronic Filing Requirements for Tax Year

year per file.

2011, for record specifications.

Line 3: Enter submitter’s Connecticut Tax Registration Number if

CD Labels

applicable.

Each CD must be labeled with an external label. See Example

Line 4: Enter submitter’s Federal Employer Identification Number

below.

(FEIN).

The external label must identify:

Line 5: Enter number of CDs submitted with this form.

1. Return type - Form W-2

Line 6: Enter number of employers covered by this submittal.

2. File type - original or replacement;

Line 7: Enter total employee records submitted with this form.

3. Calendar year;

Line 8: Enter submitter’s name and address.

4. Submitter FEIN;

Line 9: Enter name, title, and telephone number of person to contact

5. Submitter name (RA record);

about problem CDs.

6. Number of employers (RE records) on the file;

Line 10: Use this section to report employer information.

7. Number of employees (RS records) on the file;

Complete a box for each employer included in the CD

file. If reporting data for more than four employers, use

8. Return type - Form W-2;

Form CT-6559A, Submitter Report for Form W-2 Compact Disc

9. Volume - Number multiple CD’s sequential as Vol 1 of X; and

(CD) Filing Continuation Sheet.

10. Contact name and telephone number.

Declaration Requirements

Send CDs with transmittal form(s) and Forms CT-W3 to:

A submitter, service bureau, paying agent, or disbursing agent

Department of Revenue Services

(agent) may sign Form CT-6559 on behalf of the employer (or

State of Connecticut

other person required to file), if both conditions below are met:

PO Box 2930

1. The agent has the authority to sign the form under an agency

Hartford CT 06104-2930

agreement (oral, written, or implied) valid under Connecticut

If a PO Box cannot be used, send to:

state law; and

Department of Revenue Services

2. The agent signs the form and adds the caption “For: (name of

Attn: Processing II, 15th Floor

the employer or other person required to file).”

25 Sigourney St Ste 2

The authorized agent’s signing of the declaration on the employer’s

Hartford CT 06106-5032

behalf does not relieve the payer of the responsibility for filing a

Do not enclose paper W-2 forms or other notes.

correct, complete, and timely Form CT-6559; or the applicable

Forms and Publications

penalties.

Visit the DRS website at to download and print

Connecticut tax forms and publications.

TTY, TDD, and Text Telephone users only may transmit inquiries

anytime by calling 860-297-4911.

Example:

Form W-2 CD Label

1. Return type: Form W-2

2. File type:

Original

Replacement

3. Calendar year:

4. Submitter name:

5. FEIN:

6. Number of employers:

7. Number of employees:

8. Vol.

of

9. Contact name:

Telephone number: (

)

Form CT-6559 Back (Rev. 01/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2