Instructions For Form Mo-Pts

ADVERTISEMENT

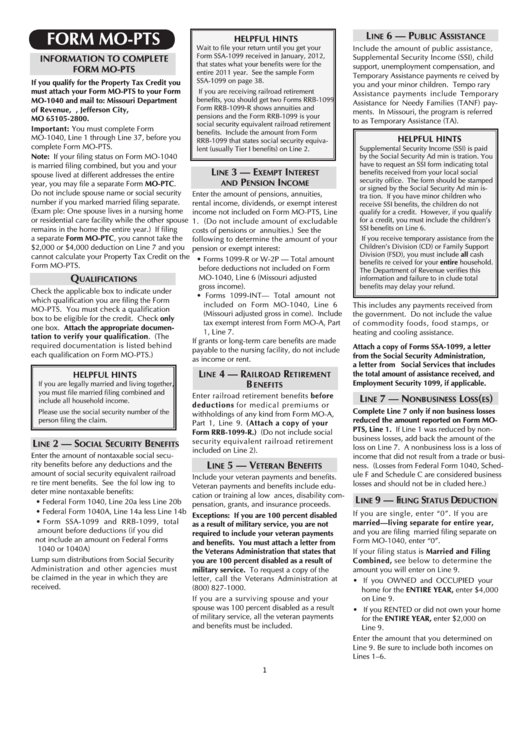

FORM MO-PTS

l

6 — p

a

ine

uBlic

ssistance

HELPFUL HINTS

Wait to file your return until you get your

Include the amount of public assistance,

Form SSA-1099 received in January, 2012,

INFORMATION TO COMPLETE

Supplemental Security Income (SSI), child

that states what your benefits were for the

support, unemployment compensation, and

FORM MO-PTS

entire 2011 year. See the sample Form

Temporary Assistance payments re c eived by

SSA-1099 on page 38.

If you qualify for the Property Tax Credit you

you and your minor children. Tempo rary

must attach your Form MO-PTS to your Form

If you are receiving railroad retirement

Assistance payments include Temporary

benefits, you should get two Forms RRB-1099.

MO-1040 and mail to: Missouri Department

Assistance for Needy Families (TANF) pay-

Form RRB-1099-R shows annuities and

of Revenue, P.O. Box 2800, Jefferson City,

ments. In Missouri, the program is referred

pensions and the Form RRB-1099 is your

MO 65105-2800.

to as Temporary Assistance (TA).

social security equivalent railroad retirement

Important: You must complete Form

benefits. Include the amount from Form

MO-1040, Line 1 through Line 37, before you

HELPFUL HINTS

RRB-1099 that states social security equiva-

complete Form MO-PTS.

Supplemental Security Income (SSI) is paid

lent (usually Tier I benefits) on Line 2.

Note: If your filing status on Form MO-1040

by the Social Security Ad m in i s t ration. You

have to request an SSI form indicating total

is married filing combined, but you and your

l

3 — e

i

ine

xempt

nterest

benefits received from your local social

spouse lived at different addresses the entire

p

i

security office. The form should be stamped

and

ension

ncome

year, you may file a separate Form MO-PTC.

or signed by the Social Security Ad m in i s-

Do not include spouse name or social security

Enter the amount of pensions, annuities,

tra tion. If you have minor children who

number if you marked married filing separate.

rental income, dividends, or exempt interest

receive SSI benefits, the children do not

(Exam ple: One spouse lives in a nursing home

income not included on Form MO-PTS, Line

qualify for a credit. However, if you qualify

or residential care facility while the other spouse

for a credit, you must include the children’s

1. (Do not include amount of excludable

SSI benefits on Line 6.

remains in the home the entire year.) If filing

costs of pensions or annuities.) See the

a separate Form MO-PTC, you cannot take the

If you receive temporary assistance from the

following to determine the amount of your

Children’s Division (CD) or Family Support

$2,000 or $4,000 deduction on Line 7 and you

pension or exempt interest:

Division (FSD), you must include all cash

cannot calculate your Property Tax Credit on the

• Forms 1099-R or W-2P — Total amount

benefits re ceived for your entire household.

Form MO-PTS.

before deductions not included on Form

The Department of Revenue verifies this

Q

MO-1040, Line 6 (Missouri adjusted

information and failure to in clude total

ualifications

gross income).

benefits may delay your refund.

Check the applicable box to indicate under

• F orms 1099-INT— Total amount not

which qualification you are filing the Form

included on Form MO-1040, Line 6

This includes any payments received from

MO-PTS. You must check a qualification

(Missouri adjusted gross in come). Include

the government. Do not include the value

box to be eligible for the credit. Check only

tax exempt interest from Form MO-A, Part

of commodity foods, food stamps, or

one box. Attach the appropriate documen-

1, Line 7.

heating and cooling assistance.

tation to verify your qualification. (The

If grants or long-term care benefits are made

required documentation is listed behind

Attach a copy of Forms SSA-1099, a letter

payable to the nursing facility, do not include

each qualification on Form MO-PTS.)

from the Social Security Administration,

as income or rent.

a letter from Social Services that includes

l

4 — r

r

the total amount of assistance received, and

HELPFUL HINTS

ine

ailroad

etirement

B

Employment Security 1099, if applicable.

If you are legally married and living together,

enefits

you must file married filing combined and

Enter railroad retirement benefits before

l

7 — n

l

(

)

ine

onBusiness

oss

es

include all household income.

deductions for medical premiums or

Complete Line 7 only if non business losses

Please use the social security number of the

withholdings of any kind from Form MO-A,

reduced the amount reported on Form MO-

person filing the claim.

Part 1, Line 9. (Attach a copy of your

PTS, Line 1. If Line 1 was reduced by non-

Form RRB-1099-R.) (Do not include social

business losses, add back the amount of the

security equivalent railroad retirement

l

2 — s

s

B

ine

ocial

ecurity

enefits

loss on Line 7. A nonbusiness loss is a loss of

included on Line 2).

Enter the amount of nontaxable social secu-

income that did not result from a trade or busi-

l

5 — V

B

rity benefits before any deductions and the

ine

eteran

enefits

ness. (Losses from Federal Form 1040, Sched-

amount of social security equivalent railroad

ule F and Schedule C are considered business

Include your veteran payments and benefits.

re tire ment benefits. See the fol low ing to

losses and should not be in cluded here.)

Veteran payments and benefits include edu-

deter mine nontaxable benefits:

cation or training al low ances, disability com-

l

9 — f

s

d

ine

iling

tatus

eduction

• Federal Form 1040, Line 20a less Line 20b

pensation, grants, and insurance proceeds.

• Federal Form 1040A, Line 14a less Line 14b

If you are single, enter “0”. If you are

Exceptions: If you are 100 percent disabled

• Form SSA-1099 and RRB-1099, total

married—living separate for entire year,

as a result of military service, you are not

amount before deductions (if you did

and you are filing married filing separate on

required to include your veteran payments

not include an amount on Federal Forms

Form MO-1040, enter “0”.

and benefits. You must attach a letter from

1040 or 1040A)

the Veterans Administration that states that

If your filing status is Married and Filing

Lump sum distributions from Social Security

you are 100 percent disabled as a result of

Combined, see below to determine the

Administration and other agencies must

military service. To request a copy of the

amount you will enter on Line 9.

be claimed in the year in which they are

letter, call the Veterans Administration at

• I f you OWNED and OCCUPIED your

received.

(800) 827-1000.

home for the ENTIRE YEAR, enter $4,000

If you are a surviving spouse and your

on Line 9.

spouse was 100 percent disabled as a result

• I f you RENTED or did not own your home

of military service, all the veteran payments

for the ENTIRE YEAR, enter $2,000 on

and benefits must be included.

Line 9.

Enter the amount that you determined on

Line 9. Be sure to include both incomes on

Lines 1–6.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2