Form K-120el - Kansas Business Income Election

ADVERTISEMENT

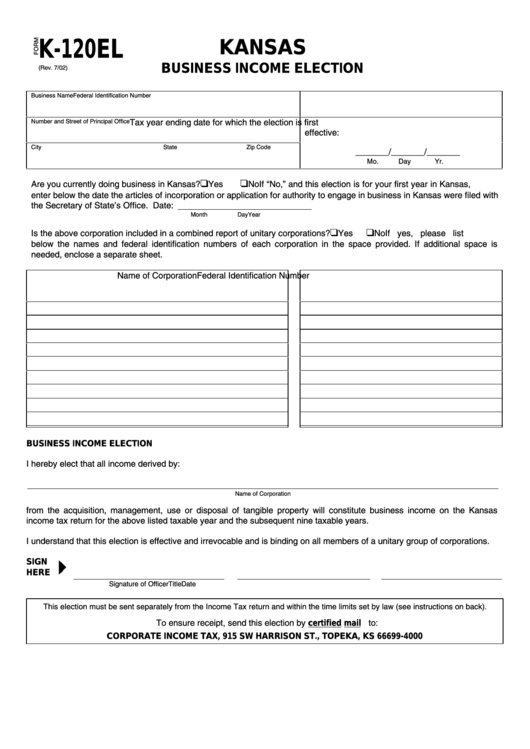

K-120EL

KANSAS

BUSINESS INCOME ELECTION

(Rev. 7/02)

Business Name

Federal Identification Number

Number and Street of Principal Office

Tax year ending date for which the election is first

effective:

City

State

Zip Code

_______/_______/_______

Mo.

Day

Yr.

❑

❑

Are you currently doing business in Kansas?

Yes

No

If “No,” and this election is for your first year in Kansas,

enter below the date the articles of incorporation or application for authority to engage in business in Kansas were filed with

the Secretary of State’s Office. Date:

Month

Day

Year

❑

❑

Is the above corporation included in a combined report of unitary corporations?

Yes

No

If yes, please list

below the names and federal identification numbers of each corporation in the space provided. If additional space is

needed, enclose a separate sheet.

Name of Corporation

Federal Identification Number

BUSINESS INCOME ELECTION

I hereby elect that all income derived by:

Name of Corporation

from the acquisition, management, use or disposal of tangible property will constitute business income on the Kansas

income tax return for the above listed taxable year and the subsequent nine taxable years.

I understand that this election is effective and irrevocable and is binding on all members of a unitary group of corporations.

SIGN

HERE

Signature of Officer

Title

Date

This election must be sent separately from the Income Tax return and within the time limits set by law (see instructions on back).

To ensure receipt, send this election by certified mail to:

CORPORATE INCOME TAX, 915 SW HARRISON ST., TOPEKA, KS 66699-4000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2