Form Mo-1040p - Booklet Missouri Property Tax Credit/ Pension Exemption Short Form - 2011 Page 11

ADVERTISEMENT

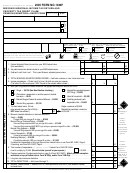

MILITARY PENSION

MISSOURI ITEMIZED

l

8 — s

InE

tAtE And

l

I

t

CALCULATION

DEDUCTIONS

oCAl

nComE

AxEs

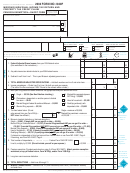

Include the amount of income taxes

You cannot itemize your Missouri

A military pension is a pension

from Federal Form 1040, Schedule

de duc tions if you took the standard

received for your service in a branch of

A, Line 5. The amount you paid in

deduction on your federal return. See

the armed services of the United States,

state income taxes included in your

Pages 6 and 7, Line 8.

including the Missouri Army Reserve

federal itemized deductions, must be

and Missouri National Guard. You

You must itemize your Missouri

sub t racted to determine Missouri item-

must reduce your military pension

de duc tions if you were required to

ized deductions.

exemption by any portion of your

itemize on your federal return.

military pension that is included

l

9 — E

t

InE

ARnIngs

AxEs

l

1 — F

InE

EdERAl

in the calculation of your public

I

d

If you entered an amount on Line 8

pension exemption. Therefore, if

tEmIzEd

EduCtIons

and you live or work in the Kansas

you qualify for the public pension

Include your total federal itemized

City or St. Louis area, you may have

exemption, make sure you complete

deductions from Federal Form 1040,

included earnings taxes. Include on

the Public Pension Calculation (Section

Line 40, and any approved cul t ural

Line 9 the amount of earnings taxes

A) before you calculate your military

contributions (literary, musical, scholas-

withheld shown on Forms W-2. See

pension exemption.

tic, or artistic) to a tax exempt agency

Diagram Page 32, Box 19.

l

1 — t

m

or institution that is operated on a

InE

AxAblE

IlItARy

l

11 — t

InE

otAl

not-for-profit basis. Cash contributions

R

b

EtIREmEnt

EnEFIts

I

d

do not qualify.

tEmIzEd

EduCtIons

Include your total military retirement

l

2

3 — s

If your total Missouri itemized

InEs

And

oCIAl

benefits reported on federal Form

deductions are less than your standard

s

t

(FICA)

1040A, Line 12b or federal Form 1040,

ECuRIty

Ax

deduction (see Pages 6 and 7, Line 8)

Line 16b. If you are filing a combined

Social security tax is the amount in

you should take the standard deduc-

return and both spouses had military

the social security tax withheld box

tion on the front of Form MO-1040P,

retirement, combine those amounts on

on Forms W-2. The amount cannot

Line 8, unless you were required to

Line 1.

exceed $4,486. Your Medicare is the

itemize your federal deductions. If you

l

2 — t

P

InE

AxAblE

ublIC

amount in the Medicare tax withheld

are required to itemize on the federal

P

EnsIon

box on Forms W-2. Enter the total on

return, you must use the itemized

Line 2. Repeat for your spouse and

amount from the itemized worksheet.

Include your total retirement benefits

enter the total on Line 3.

Attach a copy of Federal Form 1040

from public sources (including mili-

(pages 1 and 2) and Federal Schedule A.

tary) reported on federal Form 1040A,

l

4

5 — R

InEs

And

AIlRoAd

Line 12b or federal Form 1040, Line

FORM MO-PTS

R

t

EtIREmEnt

Ax

16b. If you are filing a combined return

and both spouses had retirement bene-

Include the amount of railroad retire-

Information to Complete

fits from public sources, combine those

ment tax withheld from your wages, Tier

Form MO-PTS

amounts on Line 2.

I and Tier II, during 2011. The amount

l

4 — m

b

cannot exceed $7,575. (Tier I maxi-

If you qualify for the Property Tax

InE

IlItARy

EnEFIts

mum of $4,486 and Tier II max i m um

Credit you must attach your Form

I

P

P

nCludEd In

ublIC

EnsIon

MO-PTS to your Form MO-1040P and

of $3,089.) Enter the total on Line 4.

E

xEmPtIon

Repeat for your spouse and enter the

mail to: Missouri Department of Rev-

Multiply the percentage calculated

enue, P.O. Box 2800, Jefferson City,

total on Line 5.

on Line 3 by the total public pension

MO 65105-2800.

If you have both FICA and railroad

amount reported on Line 14 of

retirement tax, the maximum de duc-

Important: You must complete Form

Section A. If you did not claim a

tion allowed is the amount withheld

MO-1040P, Line 1 through Line 19,

public pension, enter $0.

as shown on the Forms W-2 less,

before you complete Form MO-PTS.

l

6 — t

m

InE

otAl

IlItARy

either the amount entered on Federal

Note: If your filing status on Form

P

Form 1040, Line 69, or, if only one

EnsIon

MO-1040P is married filing combined,

employer, the amount refunded by

but you and your spouse lived at

The maximum military exemption

the employer.

different addresses the entire year, you

you may claim in 2011 is equal to

may file a separate Form MO-PTC. Do

30 percent of your military pension.

l

6 —

InE

not include spouse name and social

Multiply the amount on Line 5 by 30

s

-E

t

ElF

mPloymEnt

Ax

security number if you marked married

percent.

Include the amount from Federal Form

filing separate.

1040, Line 56 minus Line 27 or Federal

Form 1040NR, Line 54 minus Line 27.

11

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32