Form Mo-1040p - Booklet Missouri Property Tax Credit/ Pension Exemption Short Form - 2011 Page 5

ADVERTISEMENT

l

F

P

F

-

F

C

t

b

R

AtE

IlIng And

AymEnt

Ill

In

oRms thAt

AlCulAtE

AxPAyER

Ill oF

Ights

Go to

Simple interest is charged on all

To obtain a copy of the Taxpayer Bill

individual/ to enter your tax informa-

delinquent taxes. The interest rate

of Rights, go to our web site at

will be updated annually and can be

tion and let us do the math for you. No

individual/.

found on the Department of Revenue’s

calculation errors means faster process-

F

d

IlIng FoR

ECEAsEd

web site at

ing. Just print, sign, and mail the return.

I

ndIvIduAls

individual/. For timely filed returns,

These forms contain a 2-D barcode at

Any existing POA pending with the

an addition to tax of 5 per c ent (of the

the top right portion of the form. This al-

Department of Revenue is terminated

unpaid tax) is added if the tax is not

lows quicker processing of your return.

when the death of the taxpayer is made

paid by the return’s due date.

m

R

I

IssouRI

EtuRn

nquIRy

known to the Department. A new POA

For returns not filed by the due date,

To check the status of your current

(Form 2827) is required after death

an addition to tax of 5 percent per

year return 24 hours a day, please

of the taxpayer before any party may

month (of the unpaid tax) is added for

visit our web site:

discuss the taxpayer’s debt with the

each month the return is not filed. The

personal/individual/ or call our auto-

Department staff.

addition to tax cannot exceed 25 per-

mated individual income tax in q uiry

If an individual passed away in 2011,

cent. Note: If you file an extension,

line at (573) 526-8299. To obtain the

a claim may be filed by the surviving

a 5 percent addition to tax charge will

status of your return, you must know

spouse if the filing status is “married fil-

still apply if the tax is not paid by the

the following information: 1) the first

ing combined” and all other qualifica-

original return’s due date.

social security number on the return;

tions are met. If there is no surviving

If you are unable to pay the tax owed

2) the filing status shown on your

spouse, the estate may file the claim.

in full on the due date, please visit the

return; and 3) the exact amount of the

A copy of the death certificate must be

Department of Revenue’s web site at

refund or balance due in whole dollars.

attached and if the check is to be is-

individual

A

C

ddREss

hAngE

sued in another name, a Federal Form

for your payment options.

1310 must also accompany the claim.

If you move after filing your return,

W

m

y

R

hERE to

AIl

ouR

EtuRn

To obtain Federal Form 1310, see “To

notify both the post office serving your

If you are due a refund or have no

Obtain Forms” on page 4 or go to

old address and the Department of

amount due, mail your return and all

Revenue of your address change. Address

required attachments to:

change requests should be mailed to:

FORM MO-1040P

Department of Revenue

Department of Revenue, P.O. Box

P.O. Box 2800

2200, Jefferson City, MO 65105-2200.

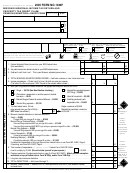

Information To Complete

Jefferson City, MO 65105-2800

This will help for w ard any refund check

If you have a balance due, mail your

Form MO-1040P

or correspondence to your new address.

return, payment, and all required

You may complete our online address

Name, Address, Etc.

attach m ents to:

change form at the following web

Department of Revenue

If all the address information is correct

address

P.O. Box 3395

individual/.

on the pre-printed label (if available),

Jefferson City, MO 65105-3395

attach the label to the Form MO-1040P

C

’

u

t

onsumER

s

sE

Ax

ALL 2-D barcode returns, see page 2.

and print or type your social security

Use tax is imposed on the storage, use

num b er(s) in the spaces pro v ided. If

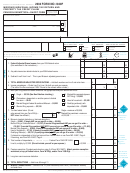

d

C

ollARs And

Ents

or consumption of tangible personal

you did not receive a book with a

Rounding is required on your tax

property in this state. The state use tax

peel-off label, or the label is incorrect,

return. Zeros have been placed in the

rate is 4.225 percent. Cities and coun-

print or type your name(s), address,

cents column on your return. For 1

ties may impose an additional local

and social security num b er(s) in the

cent through 49 cents, round down to

use tax. Use tax does not apply if the

spaces pro v ided on the return.

the previous whole dollar amount. For

purchase is subject to Missouri sales

If the taxpayer or spouse died in 2011,

50 cents through 99 cents, round up to

tax or otherwise exempt. A purchaser

check the appropriate box.

the next whole dollar amount.

is required to file a use tax return if

Example:

the cumulative purchases on which

A

62

64

gE

thRough

Round $32.49 down to $32.00

tax was not paid to the seller exceed

Round $32.50 up to $33.00

If you or your spouse were ages 62,

$2,000 in a calendar year. You can

63, or 64 by December 31, 2011,

use the Form 4340, Consumer’s Use

A

R

mEndEd

EtuRn

check the appropriate box.

Tax Return located on page 27. The

You must use Form MO-1040 (long

due date for Form 4340 is April 17,

form) for the year being amended.

2012.

See information on page 4 on how to

obtain Form MO-1040 and instructions.

5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32