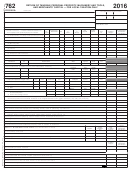

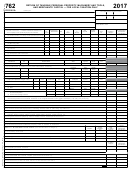

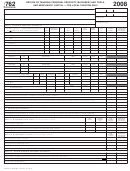

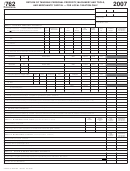

Form 762 - Return Of Tangible Personal Property, Machinery And Tools, And Merchants' Capital - For Local Taxation Only Page 2

ADVERTISEMENT

FORM 762 (2013)

Page 2

Fair Market Value

Fair Market Value

as Ascertained by

PART IV OTHER TANGIBLE PERSONAL PROPERTY

as Listed by

Commissioner

Taxpayer

of the Revenue

25. (a) Horses, mules and other kindred animals . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(b) Cattle . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(c) Sheep and goats . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(d) Hogs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(e) Poultry — chickens, turkeys, ducks, geese, etc. . . . . . . . . . . . . . . . . . . . . . . . . . .

(f) Equipment used by farmers or cooperatives to produce ethanol derived primarily from farm products . . . . . . . . . . . . . . . . . .

(g) Grains and other feeds used for the nurture of farm animals . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(h) Grain, tobacco and other agricultural products in the hands of a producer . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(i) Equipment and machinery used by farm wineries in the production of wine . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26. Felled timber, ties, poles, cord wood, bark and other timber products . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27. (a) Refrigerators, deep freeze units, air conditioners and automatic refrigerating machinery . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(b) Vacuum cleaners, sewing machines, washing machines, dryers and all other household machinery . . . . . . . . . . . . . . . . . . .

(c) Pianos and organs, television sets, radios, phonographs and records and all other musical instruments . . . . . . . . . . . . . . . .

(d) Watches and clocks and gold and silver plates and plated ware . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(e) Oil paintings, pictures, statuary, and other works of art $

_ ______ books $

_ _______ . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(f) Diamonds, cameos and other precious stones and precious metals used as ornaments or jewelry . . . . . . . . . . . . . . . . . . . .

(g) Sporting and photographic equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(h) Firearms and weapons of all kinds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(i) Bicycles and lawn mowers, hand or power . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(j) Household and kitchen furniture (state number of rooms

______ ) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28. Seines, pound nets, fykes, weirs and other devices for catching fish . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

29. Poles, wires, switchboards, etc., telephone or telegraph instruments, apparatus, etc., owned by any person, firm, association or company not incorporated .

30. Toll bridges, turnpikes and ferries (except steam ferries owned and operated by chartered company) . . . . . . . . . . . . . . . . . . . .

31. Total of Part IV (add lines 25 through 30 and enter on line 22) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

GENERAL INSTRUCTIONS:

Complete Form 762, reporting property which you owned on January 1, 2013, then file it with the Commissioner of

the Revenue of the County or City generally on or before May 1, 2013. Since some localities have due dates other than May 1, you may want to

contact your local office to be sure of the proper due date. Write the word “None” opposite each item of property which you do not own. No property is

assessable as tangible personal property if defined by Va. Code § 58.1-1100 as intangible personal property. If additional space is needed, attach a

separate schedule. Note: If your motor vehicle is considered by State Law to have a business usage, it does not qualify for Car Tax Relief. Your vehicle

is classified as having business usage if any of the following circumstances apply: 1) more than 50% of the mileage for the year was reported as a

business expense for Federal Income Tax purposes or reimbursed by an employer; 2) more than 50% of the depreciation associated with the vehicle

is deducted as a business expense for Federal Income Tax purposes; 3) the cost of the vehicle is expensed pursuant to IRC § 17; or 4) the vehicle is

leased by an individual and the leasing company pays the tax without reimbursement from the individual.

DEFINITION OF MANUFACTURED HOMES (ALSO KNOWN AS MOBILE HOMES) FOR PART I, LINE 3

“Manufactured home” means a structure subject to federal regulation, which is transportable in one or more sections; is eight body feet or more in

width and 40 body feet or more in length in the traveling mode, or is 320 or more square feet when erected on site; is built on a permanent chassis;

is designed to be used as a single-family dwelling, with or without a permanent foundation, when connected to the required utilities; and includes the

plumbing, heating, air-conditioning, and electrical systems contained in the structure (Va. Code § 36-85.3). “Manufactured homes” are also known as

“mobile homes.”

INFORMATION FOR PART II, MACHINERY AND TOOLS

If you are engaged in a manufacturing, mining, water well drilling, processing or reprocessing, radio or television broadcasting, dairy, dry cleaning

or laundry business, report all machinery and tools used in manufacturing, mining, water well drilling, processing or reprocessing, radio or television

broadcasting, dairy, dry cleaning or laundry business, such machinery and tools being segregated by Va. Code § 58.1-3507, as amended for local

taxation exclusively, and each county, city and town being required to make a separate classification for all such machinery and tools.

INFORMATION FOR PART III, MERCHANTS’ CAPITAL

If you are a merchant and if locality taxes the capital of merchants, report all other taxable personal property of any kind whatsoever, except money on

hand and on deposit and except tangible personal property not offered for sale as merchandise, which tangible personal property should be reported

as such on front of this return under the heading “TANGIBLE PERSONAL PROPERTY.”

FOR EXECUTORS, ADMINISTRATORS, TRUSTEES, COMMITTEES, GUARDIANS AND OTHER FIDUCIARIES

If this is the return of tangible personal property, machinery and tools, or merchants’ capital in the hands of an executor, administrator, trustee, committee,

guardian or other fiduciary, such fiduciary must complete so much of both pages of this return as pertains to such property and, in addition, supply the

information called for below:

1. C haracter of Fiduciary: Executor

Administrator

Trustee

Committee

Guardian

Other

________________

j

j

j

j

j

j

Specify

2. N ame of Estate, Trust or Ward ________________________________________________________________________________________________

DECLARATION OF TAXPAYER

I

declare

that

the

statement

and

figures

submitted

on

both

pages

of

this

return

are

true,

full

and

correct

to

the

best

of

my

knowledge

and

belief. I

certify that unless otherwise indicated as business use, the vehicles listed herein are for personal use.

NOTE — It is a misdemeanor for any person willfully to subscribe a return which he does not believe to be true and correct as to every material matter

(Va. Code § 58.1-11).

_______________________________________________________________

_________________________________

________________________________________________

(Signature of Taxpayer)

(Date)

(Taxpayer’s Phone Number)

Executors, administrators, trustees and other fiduciaries must also supply information called for on this return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2