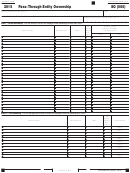

2014

PASS-THROUGH ENTITY

MARYLAND

FORM

SCHEDULE K-1 INSTRUCTIONS

510

SCHEDULE K-1

General Instructions

Line 2 - Enter the member’s distributive or pro rata share

of any nonresident tax paid on behalf of this

Use Form 510 Schedule K-1 to report the distributive or pro

entity by other pass-through entities. This line

rata share of the member’s income, additions, subtractions,

is the member’s distributive or pro rata share of

nonresident tax, and credits allocable to Maryland.

Maryland Form 510, line 16c.

Specific Instructions

Line 3 - Add lines 1 and 2 and enter total on line 3.

Enter the fiscal year used by the pass-through entity in the

Members: Include this amount on Form 500, line

header of this form, if the pass-through entity is not using a

15f; Form 502CR, Part I, line 5; Form 504, line

calendar year.

33; Form 505, line 46; Form 510, line 16c.

Information about the Pass-Through Entity

Section E. Credits

Enter the name, address, and Federal Employer Identification

Nonrefundable – The PTE will enter the member’s distributive

Number (FEIN).

or pro rata share of amount of any business tax credits reported

on the Maryland Form 500CR section of its electronic return.

Information about the Member

The PTE member will report the share of credit on Form 500CR

Enter the name, address, Social Security Number/Federal

or Form 504CR (if the PTE member is a fiduciary taxpayer.)

Employer Identification Number (FEIN), residency information,

Refundable – The PTE will enter the member’s distributive

and percentage of distributive or pro rata share.

or pro rata share of amount of any business tax credits from

Section A. Member’s Income

Maryland Form 500CR or Form 502S (See exception for One

Maryland Economic Development Tax Credit below.). The PTE

Line 1 - Enter federal distributive or pro rata share of

member will report the share of credit on Form 500CR or Form

income from federal Schedule K-1.

504CR (if the PTE member is a fiduciary taxpayer).

Line 2 - Enter nonresident member’s distributive or pro

One Maryland Economic Development Tax Credit –

rata share allocable to Maryland, as shown on

See Part P of Maryland Form 500CR Instructions for more

Maryland Form 510, Schedule B.

information. If the PTE is a qualified business eligible to pass

Section B. Additions

on a refundable One Maryland Economic Development Tax

Credit, check the box for Refundable. If the PTE is a qualified

Enter member’s distributive or pro rata share of additions.

business which is eligible to pass on only the nonrefundable

Section C. Subtractions

portion of the One Maryland Economic Development Tax Credit,

check the box for Nonrefundable.

Enter member’s distributive or pro rata share of subtractions.

Section F. Additional Information

Section D. Nonresident Tax

The PTE will enter any other additions or subtractions from

Line 1 - Complete only if member is a nonresident. Enter

section B, line 5 or C, line 5 with amounts, as well as any

the member’s distributive or pro rata share

other information needed to complete the member’s return.

of any nonresident tax paid on behalf of the

For example, additional information may include Oil Depletion

member by this pass-through entity. This line

Allowance or Domestic Production Activities Deduction.

is the member’s distributive or pro rata share

of Maryland Form 510, lines 16a, 16b, and the

additional tax paid with the return.

Note: All taxpayers, other than fiduciaries, must file their return electronically to claim or pass on a business income tax credit from

Form 500CR. In addition, Corporations and Pass-through Entities must file their returns electronically to claim or pass on a Sustainable

Communities Tax Credit from Form 502S.

COM/RAD 045

1

1 2

2 3

3