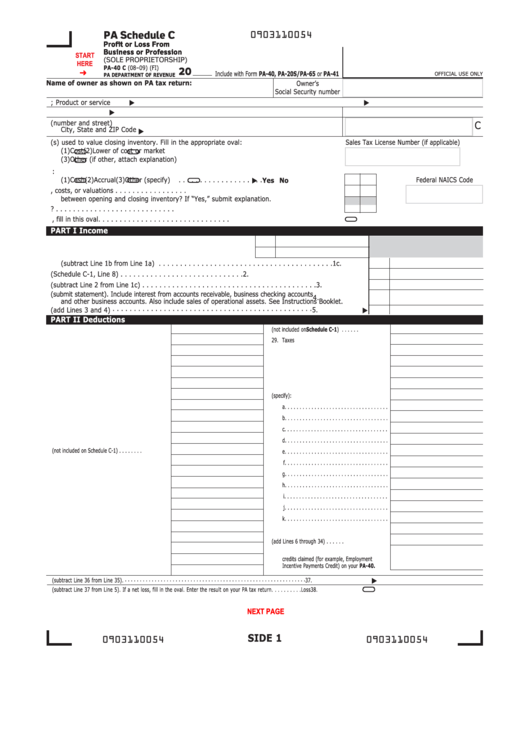

PA Schedule C

0903110054

Profit or Loss From

Business or Profession

START

(SOLE PROPRIETORSHIP)

HERE

PA-40 C (08–09) (FI)

20

Include with Form PA-40, PA-20S/PA-65 or PA-41

OFFICIAL USE ONLY

PA DEPARTMENT OF REVENUE

Name of owner as shown on PA tax return:

Owner’s

Social Security number

A. Main business activity

; Product or service

C. Federal Employer Identification Number

B. Business name

D. Business address (number and street)

C

City, State and ZIP Code

E. Method(s) used to value closing inventory. Fill in the appropriate oval:

Sales Tax License Number (if applicable)

(1)

Cost

(2)

Lower of cost or market

(3)

Other (if other, attach explanation)

F. Accounting method. Fill in the appropriate oval:

(1)

Cash

(2)

Accrual

(3)

Other (specify)

. . . . . . . . . . . . . . . . . . . . Yes No

Federal NAICS Code

G. Was there any change in determining quantities, costs, or valuations . . . . . . . . . . . . . . . . .

between opening and closing inventory? If “Yes,” submit explanation.

H. Did you deduct expenses for an office in your home? . . . . . . . . . . . . . . . . . . . . . . . . . . . .

I. If the business is out of existence, fill in this oval. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

PART I Income

1. a. Gross receipts or sales . . . . . . . . . . . . . . . . . . . . . . . . . . 1a.

b. Returns and allowances . . . . . . . . . . . . . . . . . . . . . . . . . . 1b.

c. Balance (subtract Line 1b from Line 1a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1c.

2. Cost of goods sold and/or operations (Schedule C-1, Line 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

3. Gross profit (subtract Line 2 from Line 1c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

4. Other Income (submit statement). Include interest from accounts receivable, business checking accounts

4.

and other business accounts. Also include sales of operational assets. See Instructions Booklet.

5. Total income (add Lines 3 and 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

PART II Deductions

6. Advertising . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28. Supplies (not included on Schedule C-1) . . . . . .

29. Taxes

7. Amortization . . . . . . . . . . . . . . . . . . . . . . . . . . .

30. Telephone . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8. Bad debts from sales or services . . . . . . . . . . . .

31. Travel and entertainment . . . . . . . . . . . . . . . . . .

9. Bank charges . . . . . . . . . . . . . . . . . . . . . . . . . .

10. Car and truck expenses . . . . . . . . . . . . . . . . . . .

32. Utilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11. Commissions . . . . . . . . . . . . . . . . . . . . . . . . . .

33. Wages . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12. Cost depletion but not percentage depletion . . . .

34. Other expenses (specify):

13. a.

Regular depreciation . . . . . . . . . . . . . . . . .

a. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13. b.

Section 179 expense . . . . . . . . . . . . . . . .

b. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14. Dues and publications . . . . . . . . . . . . . . . . . . . .

c. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15. Employee benefit programs other than on Line 23

d. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16. Freight (not included on Schedule C-1) . . . . . . . .

e. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17. Insurance . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

f. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18. Interest on business indebtedness . . . . . . . . . . .

g. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19. Laundry and cleaning . . . . . . . . . . . . . . . . . . . .

h. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20. Legal and professional services . . . . . . . . . . . . .

i. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21. Management fees . . . . . . . . . . . . . . . . . . . . . . .

j. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22. Office supplies . . . . . . . . . . . . . . . . . . . . . . . . .

k. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23. Pension and profit-sharing plans for employees . .

34. Total other expenses . . . . . . . . . . . . . . . . . . . . .

24. Postage . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

35. Total expenses. (add Lines 6 through 34) . . . . . .

25. Rent on business property . . . . . . . . . . . . . . . . .

36. Reduce expenses by the total business

credits claimed (for example, Employment

26. Repairs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Incentive Payments Credit) on your PA-40.

27. Subcontractor fees . . . . . . . . . . . . . . . . . . . . . .

37. Total adjusted expenses (subtract Line 36 from Line 35). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

37.

38. Net profit or loss (subtract Line 37 from Line 5). If a net loss, fill in the oval. Enter the result on your PA tax return. . . . . . . . . .Loss

38.

Reset Entire Form

NEXT PAGE

PRINT FORM

SIDE 1

0903110054

0903110054

1

1 2

2 3

3 4

4 5

5 6

6