Clear form

Get forms online - tax.utah.gov

Utah State Tax Commission

Discrepancy Report

TC-941D

Rev. 5/12

For Annual Withholding Reconciliation

Tax year for this report

Check box if

Amended Report

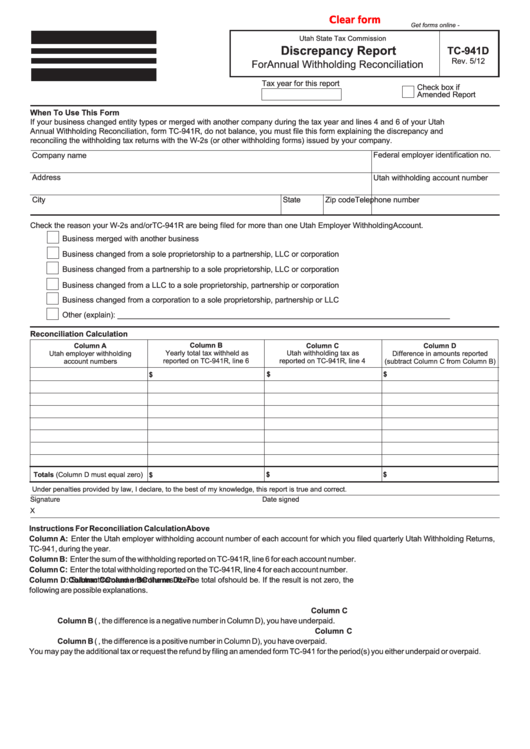

When To Use This Form

If your business changed entity types or merged with another company during the tax year and lines 4 and 6 of your Utah

Annual Withholding Reconciliation, form TC-941R, do not balance, you must file this form explaining the discrepancy and

reconciling the withholding tax returns with the W-2s (or other withholding forms) issued by your company.

Federal employer identification no.

Company name

Address

Utah withholding account number

City

State

Zip code

Telephone number

Check the reason your W-2s and/or TC-941R are being filed for more than one Utah Employer Withholding Account.

Business merged with another business

Business changed from a sole proprietorship to a partnership, LLC or corporation

Business changed from a partnership to a sole proprietorship, LLC or corporation

Business changed from a LLC to a sole proprietorship, partnership or corporation

Business changed from a corporation to a sole proprietorship, partnership or LLC

Other (explain): ______________________________________________________________________________

Reconciliation Calculation

Column B

Column C

Column A

Column D

Yearly total tax withheld as

Utah withholding tax as

Utah employer withholding

Difference in amounts reported

reported on TC-941R, line 6

reported on TC-941R, line 4

account numbers

(subtract Column C from Column B)

$

$

$

Totals (Column D must equal zero)

$

$

$

Under penalties provided by law, I declare, to the best of my knowledge, this report is true and correct.

Signature

Date signed

X

Instructions For Reconciliation Calculation Above

Column A:

Enter the Utah employer withholding account number of each account for which you filed quarterly Utah Withholding Returns,

TC-941, during the year.

Column B:

Enter the sum of the withholding reported on TC-941R, line 6 for each account number.

Column C:

Enter the total withholding reported on the TC-941R, line 4 for each account number.

Column D:

Column C

Column B

Column D

zero

Subtract

from

and enter the result. The total of

should be

. If the result is not zero, the

following are possible explanations.

1. You may have made an error. Check the amounts on TC-941s and TC-941R to ensure you entered the correct figures.

Column C

2. You may have underpaid the withholding tax. If the withholding reported in

is greater than the sum of the withholding in

Column B

(i.e., the difference is a negative number in Column D), you have underpaid.

Column C

3. You may have overpaid the withholding tax. If the withholding reported in

is less than the sum of the withholding in

Column B

(i.e., the difference is a positive number in Column D), you have overpaid.

You may pay the additional tax or request the refund by filing an amended form TC-941 for the period(s) you either underpaid or overpaid.

1

1