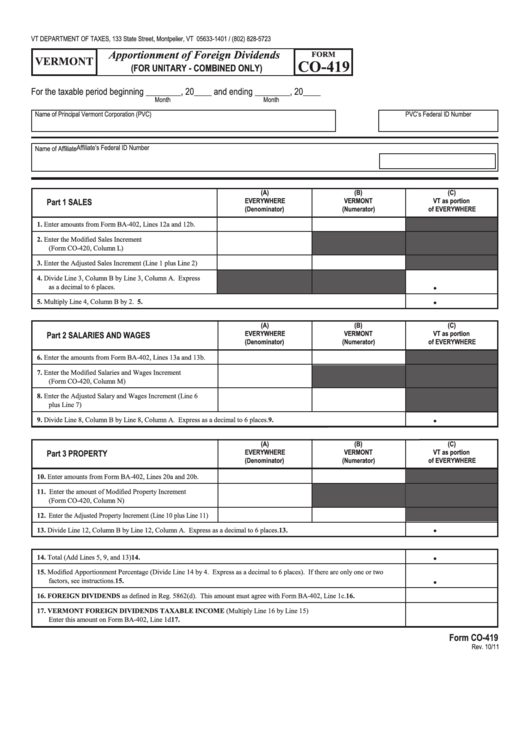

Form Co-419 - Vermont Apportionment Of Foreign Dividends

ADVERTISEMENT

VT DEPARTMENT OF TAXES, 133 State Street, Montpelier, VT 05633-1401 / (802) 828-5723

Apportionment of Foreign Dividends

FORM

VERMONT

CO-419

(FOR UNITARY - COMBINED ONLY)

For the taxable period beginning ________, 20____ and ending ________, 20____

Month

Month

Name of Principal Vermont Corporation (PVC)

PVC’s Federal ID Number

Affiliate’s Federal ID Number

Name of Affiliate

(A)

(B)

(C)

Part 1

SALES

EVERYWHERE

VERMONT

VT as portion

(Denominator)

(Numerator)

of EVERYWHERE

1. Enter amounts from Form BA-402, Lines 12a and 12b.

2. Enter the Modified Sales Increment

(Form CO-420, Column L)

3. Enter the Adjusted Sales Increment (Line 1 plus Line 2)

4. Divide Line 3, Column B by Line 3, Column A. Express

•

as a decimal to 6 places.

•

5. Multiply Line 4, Column B by 2. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.

(A)

(B)

(C)

Part 2

SALARIES AND WAGES

EVERYWHERE

VERMONT

VT as portion

(Denominator)

(Numerator)

of EVERYWHERE

6. Enter the amounts from Form BA-402, Lines 13a and 13b.

7. Enter the Modified Salaries and Wages Increment

(Form CO-420, Column M)

8. Enter the Adjusted Salary and Wages Increment (Line 6

plus Line 7)

•

9. Divide Line 8, Column B by Line 8, Column A. Express as a decimal to 6 places. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9.

(A)

(B)

(C)

EVERYWHERE

VERMONT

VT as portion

Part 3

PROPERTY

(Denominator)

(Numerator)

of EVERYWHERE

10. Enter amounts from Form BA-402, Lines 20a and 20b.

11. Enter the amount of Modified Property Increment

(Form CO-420, Column N)

12. Enter the Adjusted Property Increment (Line 10 plus Line 11)

•

13. Divide Line 12, Column B by Line 12, Column A. Express as a decimal to 6 places. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13.

•

14. Total (Add Lines 5, 9, and 13) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14.

15. Modified Apportionment Percentage (Divide Line 14 by 4. Express as a decimal to 6 places). If there are only one or two

•

factors, see instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15.

16. FOREIGN DIVIDENDS as defined in Reg. 5862(d). This amount must agree with Form BA-402, Line 1c. . . . . . . . . . . . . 16.

17. VERMONT FOREIGN DIVIDENDS TAXABLE INCOME (Multiply Line 16 by Line 15)

Enter this amount on Form BA-402, Line 1d . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17.

Form CO-419

Rev. 10/11

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2