Form Nh-1120-We Schedule Ii - Apportionment Of Foreign Dividends

ADVERTISEMENT

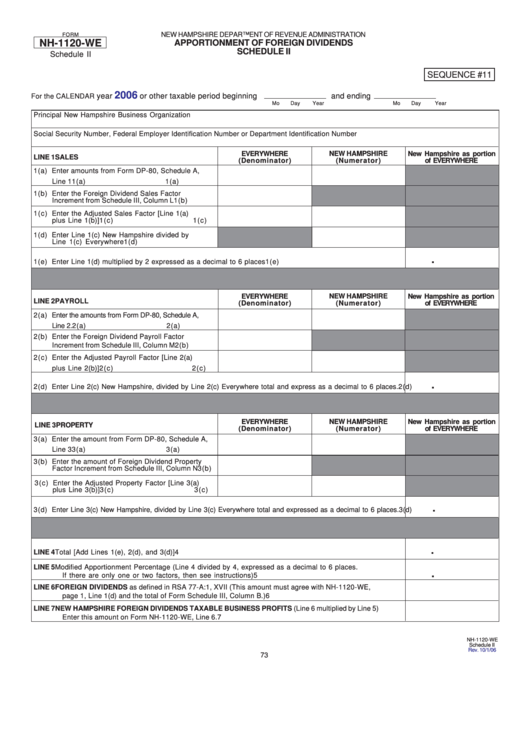

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

FORM

NH-1120-WE

APPORTIONMENT OF FOREIGN DIVIDENDS

SCHEDULE II

Schedule II

SEQUENCE #11

2006

year

or other taxable period beginning

and ending

For the CALENDAR

Mo

Day

Year

Mo

Day

Year

Principal New Hampshire Business Organization

Social Security Number, Federal Employer Identification Number or Department Identification Number

EVERYWHERE

NEW HAMPSHIRE

New Hampshire as portion

LINE 1 SALES

(Denominator)

(Numerator)

of EVERYWHERE

1(a) Enter amounts from Form DP-80, Schedule A,

Line 1

1(a)

1(a)

1(b) Enter the Foreign Dividend Sales Factor

Increment from Schedule III, Column L

1(b)

1(c) Enter the Adjusted Sales Factor [Line 1(a)

plus Line 1(b)]

1(c)

1(c)

1(d) Enter Line 1(c) New Hampshire divided by

Line 1(c) Everywhere

1(d)

.

1(e) Enter Line 1(d) multiplied by 2 expressed as a decimal to 6 places

1(e)

EVERYWHERE

NEW HAMPSHIRE

New Hampshire as portion

LINE 2 PAYROLL

(Denominator)

(Numerator)

of EVERYWHERE

2(a) Enter the amounts from Form DP-80, Schedule A,

Line 2.

2(a)

2(a)

2(b) Enter the Foreign Dividend Payroll Factor

Increment from Schedule III, Column M

2(b)

2(c) Enter the Adjusted Payroll Factor [Line 2(a)

plus Line 2(b)]

2(c)

2(c)

.

2(d) Enter Line 2(c) New Hampshire, divided by Line 2(c) Everywhere total and express as a decimal to 6 places.

2(d)

EVERYWHERE

NEW HAMPSHIRE

New Hampshire as portion

LINE 3 PROPERTY

(Denominator)

(Numerator)

of EVERYWHERE

3(a) Enter the amount from Form DP-80, Schedule A,

Line 3

3(a)

3(a)

3(b) Enter the amount of Foreign Dividend Property

Factor Increment from Schedule III, Column N

3(b)

3(c) Enter the Adjusted Property Factor [Line 3(a)

plus Line 3(b)]

3(c)

3(c)

.

3(d) Enter Line 3(c) New Hampshire, divided by Line 3(c) Everywhere total and expressed as a decimal to 6 places.

3(d)

.

LINE 4 Total [Add Lines 1(e), 2(d), and 3(d)]

4

LINE 5 Modified Apportionment Percentage (Line 4 divided by 4, expressed as a decimal to 6 places.

.

If there are only one or two factors, then see instructions)

5

LINE 6 FOREIGN DIVIDENDS as defined in RSA 77-A:1, XVII (This amount must agree with NH-1120-WE,

page 1, Line 1(d) and the total of Form Schedule III, Column B.)

6

LINE 7 NEW HAMPSHIRE FOREIGN DIVIDENDS TAXABLE BUSINESS PROFITS (Line 6 multiplied by Line 5)

Enter this amount on Form NH-1120-WE, Line 6.

7

NH-1120-WE

Schedule II

Rev. 10/1/06

73

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1