RCT-106 (07-13) (FI)

1060013205

Page 2

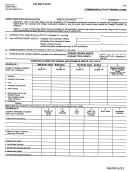

TABLES SUPPORTING DETERMINATION OF APPORTIONMENT

PERCENTAGE (Use whole dollars only.)

Apportionment for:

o

o

o

Capital Stock/Foreign Franchise and Corporate Net Income Taxes

Capital Stock/Foreign Franchise Tax Only

Corporate Net Income Tax Only

TAX YEAR

BEGINNING

TAX YEAR

CORPORATION NAME

REVENUE ID

ENDING

TABLE 1 - PROPERTY FACTOR

Description

Inside PA

Inside and Outside PA

Beginning of Period

End of Period

Beginning of Period

End of Period

Tangible Property Owned (original cost value)

Inventory . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Buildings and Depreciable Assets . . . . . . . . . . . . . . . . . . . . . .

Land . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Other Real and Tangible Personal Property . . . . . . . . . . . . . . .

Partner’s Share of Property Owned by Partnerships . . . . . . . . .

Less Construction in Progress (if included above) . . . . . . . . . . (

) (

)

(

) (

)

Totals . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Total Beginning and End of Period . . . . . . . . . . . . . . . . . . . . . . . .

Average Value (1/2 of Above) . . . . . . . . . . . . . . . . . . . . . . . . . . .

Add: Corporate Tangible and/or Real Property Rented* . . . . . . . .

Partnership Tangible and/or Real Property Rented* . . . . . . .

Total Average Value . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (A)

(B)

*Eight times net annual rental rate (Attach schedule.)

Carry (A), (B) and (C) over to RCT-101,

(C) Property Factor (Divide A by B; calculate to six decimal places.)

●

Schedule A-1, as applicable, Lines 1A, 1B and 1C.

*

(D) Property Factor Calculation (Multiply C by the appropriate

Carry (A), (B) and (D) over to RCT-101,

●

property weight factor.)

Schedule C-1, Lines 1A, 1B and 1D.

Inside PA

Inside and Outside PA

TABLE 2 - PAYROLL FACTOR

Description

Wages, Salaries, Commissions and Other Compensation

to Employees in:

Cost of Goods Sold . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Compensation of Officers . . . . . . . . . . . . . . . . . . . . . . . . . . .

Salesmen’s Salaries and Commissions . . . . . . . . . . . . . . . . . .

Other Payroll . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Partner’s Share of Payroll from Partnerships . . . . . . . . . . . . . . . . .

Total Payroll . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (A)

(B)

Carry (A), (B) and (C) over to RCT-101,

(C) Payroll Factor (Divide A by B; calculate to six decimal places.)

●

Schedule A-1, as applicable, Lines 2A, 2B and 2C.

*

(D) Payroll Factor Calculation (Multiply C by the appropriate

Carry (A), (B) and (D) over to RCT-101,

payroll weight factor.)

●

Schedule C-1, Lines 2A, 2B and 2D.

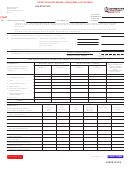

TABLE 3 - SALES FACTOR

Description

Inside PA

Inside and Outside PA

Sales (net of returns and allowances) . . . . . . . . . . . . . . . . . . . . .

Interest, Rents, Royalties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Gross Receipts from the Sale of Other Business Assets

(except securities), Unless you are a Securities Dealer . . . . . . . . .

Other Sales (receipts only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Partner’s Share of Sales from Partnerships . . . . . . . . . . . . . . . . . .

Total Sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (A)

(B)

,

Carry (A), (B) and (C) over to RCT-101

(C) Sales Factor (Divide A by B; calculate to six decimal places.)

●

Schedule A-1, as applicable, Lines 3A, 3B and 3C.

*

(D) Sales Factor Calculation (Multiply C by the appropriate

Carry (A), (B) and (D) over to RCT-101,

sales weight factor.)

●

Schedule C-1, Lines 3A, 3B and 3D.

Special apportionment to be completed only by railroad, truck, bus and airline companies; pipeline or natural gas companies; and water transportation

companies. Refer to instructions.

(A) NUMERATOR

(A)

●

(C)

=

(B) DENOMINATOR

(B)

.

Carry (A), (B) and (C) over to RCT-101, Schedules C-1 and/or A-1, as applicable, Lines 4A, 4B and 5

*

Use figures from the RCT-106, Insert Sheet chart in the CT-1 PA Corporation Tax Booklet,

REV-1200, found at

1060013205

PRINT FORM

Reset Entire Form

RETURN TO PAGE ONE

1

1 2

2