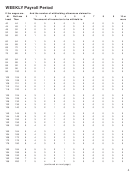

Form Wv/it-104 - West Virginia Employee'S Withholding Exemption Certificate Page 16

ADVERTISEMENT

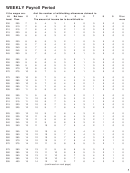

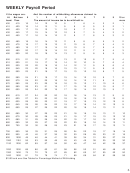

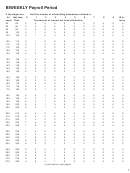

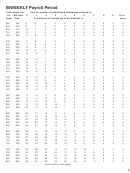

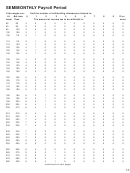

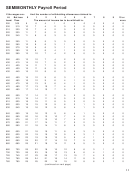

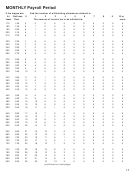

USING THE PERCENTAGE METHOD TO FIGURE THE WITHHOLDING

The amount of tax to be withheld by the employer may be determined by the percentage method as follows:

(1) Subtract the personal exemptions credit as set forth in the table below. (The maximum personal exemp-

tion credit is $2,000.00 per year for each exemption.)

(2) Determine the amount of tax to be withheld from the appropriate percentage tables on the following pages.

PERSONAL EXEMPTION TABLE

WEEKLY ............................................... $

38.46

BIWEEKLY ........................................... $

76.92

SEMIMONTHLY .................................... $

83.33

MONTHLY ............................................ $

166.67

ANNUAL ................................................ $ 2,000.00

DAILY .................................................... $

7.66

(Note: Maximum allowable exemption credit is $2,000.00 annually per exemption.)

EXAMPLE: Employee Smith, who is married and his spouse works, earns $1,250.00 semimonthly and

claims two (2) exemptions. Using the percentage chart for TWO EARNER/TWO OR MORE

JOBS the following steps were taken to determine the state income tax to be withheld.

Step No. 1

Total Wage Payment ........................................................ $1,250.00

Less Personal Exemptions Per Table

above (2 exemptions—$83.33 x 2) ...................................

166.66

Total Wage Payment Less Personal Exemptions ...................................... $1,083.34

Step No. 2

Tax From Table 3 Entry covering $1,083.34

(Over $1,000 but not over $1,500) ....................................... 39.38

Plus 6% of excess over $1,000..... ....................................... .. 5.00

Total Tax to be withheld .............................................................................

$ 44.38

Round to the nearest dollar

$ 44.00

16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20