Form Wv/it-104 - West Virginia Employee'S Withholding Exemption Certificate Page 20

ADVERTISEMENT

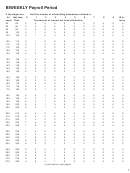

OPTIONAL ONE EARNER/ONE JOB

TABLES FOR PERCENTAGE METHOD OF WITHHOLDING

Single, head of household or married with nonemployed spouse

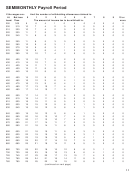

TABLE 4. MONTHLY Payroll Period

Gross Wage Minus $166.67 for Each Exemption Claimed Equals Taxable Wage.

IF TAXABLE WAGE IS:

AMOUNT TO BE WITHHELD IS:

OVER—

BUT NOT OVER—

OF EXCESS OVER—

$

0 ..................... $

833 ......................................................... 3.0% .................. $

0

$

833 ..................... $ 2083 ............. 24.99 ......... PLUS ............. 4.0% .................. $

833

$ 2083 ..................... $ 3333 ............. 74.99 ......... PLUS ............. 4.5% .................. $ 2083

$ 3333 ..................... $ 5000 ........... 131.24 ......... PLUS ............. 6.0% .................. $ 3333

OVER $5000 ....................................... 231.26 ......... PLUS ............. 6.5% .................. $ 5000

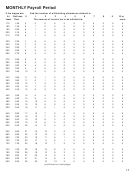

TABLE 5. ANNUAL Payroll Period

Gross Wage Minus $2000.00 for Each Exemption Claimed Equals Taxable Wage.

IF TAXABLE WAGE IS:

AMOUNT TO BE WITHHELD IS:

OVER—

BUT NOT OVER—

OF EXCESS OVER—

$

0 ..................... $ 10000 ......................................................... 3.0% .................. $

0

$ 10000 ..................... $ 25000 ........... 300.00 ......... PLUS ............. 4.0% .................. $ 10000

$ 25000 ..................... $ 40000 ........... 900.00 ......... PLUS ............. 4.5% .................. $ 25000

$ 40000 ..................... $ 60000 ......... 1575.00 ......... PLUS ............. 6.0% .................. $ 40000

OVER $60000 ................................... 2775.00 ......... PLUS ............. 6.5% .................. $ 60000

TABLE 6. DAILY Payroll Period

Gross Wage Minus $7.66 for Each Exemption Claimed Equals Taxable Wage.

IF TAXABLE WAGE IS:

AMOUNT TO BE WITHHELD IS:

OVER—

BUT NOT OVER—

OF EXCESS OVER—

$

0 ........................ $

38 ............................................................. 3.0% ..................... $

0

$

38 ........................ $

96 ................... 1.14 ......... PLUS ............. 4.0% ..................... $

38

$

96 ........................ $ 153 ................... 3.46 ......... PLUS ............. 4.5% ..................... $

96

$ 153 ........................ $ 230 ................... 6.03 ......... PLUS ............. 6.0% ..................... $ 153

OVER $230 ........................................... 10.65 ......... PLUS ............. 6.5% ..................... $ 230

20

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20