INSTRUCTIONS FOR PREPARING QUARTERLY TAX RETURN WH-1605

File WH-1605 electronically free of charge at Click on eWithholding. Payments can be made by VISA or

MasterCard or by Electronic Funds Withdrawal (EFW). Do not mail this form when filing online.

If the WH-1605 return is a refund return or a zero payment amount due return, file using Business Tax Telefile free of

charge. Call 803-898-5918 and follow step by step instructions. Do not mail this form when using Telefile.

With either of these filing methods, confirmation will be given for a successfully filed return.

DUE DATES:

First Quarter (Jan - Mar)..............April 30

Third Quarter (Jul - Sep)...............October 31

Second Quarter (Apr - Jun)..........July 31

Fourth Quarter (Oct - Dec).......Use WH-1606

Do not use WH-1605 to file 4th quarter information. Use WH-1606. WH-1605 for 4th quarter cannot be processed.

NOTE: A return MUST BE filed even if no state tax has been withheld during the quarter to prevent a delinquent notice

from being mailed. A WH-1606 reconciliation must be filed if the account was open for any portion of the calendar year.

Instructions:

DO NOT ALTER COMPLETED FIELDS ON PRE-PRINTED FORMS AS IT MAY RESULT IN ACCOUNT ERRORS.

If the top portion of the WH-1605 is not pre-printed, complete the top of the form with the name and address of the business,

the SC withholding number, the Federal Employer Identification Number (FEIN) and the year for which you are filing.

Darken circle completely if this is an amended return. Provide an explanation in the line below the circle.

Darken circle completely if changing address.

Darken circle completely if you are no longer required to withhold. Provide a close date and an explanation.

Darken the circle for the appropriate quarter.

Fill in the year in the Year box.

QUARTERLY:

Line 1

Enter total quarterly SC state income tax withheld from all sources. Enter corrected amount if filing an

amended return.

Line 2

Enter total quarterly SC state income tax deposits or payments previously made. For amended return, include

amount paid with original WH-1605.

Line 3

Enter the amount of SC state refund, if any. (SCDOR will not honor credit transfer requests.)

Line 4

Enter the amount of SC state tax due, if any.

Line 5

Enter the amount of penalty and interest due, if any.

Line 6

Enter the net SC state income tax, penalty, and interest due, if any.

TO AVOID DELAYS IN PROCESSING YOUR RETURN(S):

Must be prepared with BLACK ink only.

Do not staple attachments.

Must have all numbers written clearly (for scanner accuracy).

Must NOT contain slashes, dashes, dollar signs or commas in the block number area.

Must contain a telephone number (including area code) available during business hours.

Must be signed by person authorized to act on behalf of withholding agent.

Checks must be signed and include the written dollar amount.

Must be mailed to SCDOR at the special address shown on the return.

Must include SC Withholding file number and quarter on the "FOR" line of the check.

Clip payment to this return for the full amount due. Do not include WH-1601 coupon.

AUTHORIZATION AND SIGNATURE:

Check the "YES" box for release of confidential information. This authorizes the Director of the South Carolina

Department of Revenue or delegate to discuss this return, its attachments, any notices, adjustments or

assessments with the preparer whose name is provided.

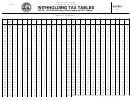

31292048

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19