PENALTIES AND INTEREST

PENALTY:

A. Failure to file return by the due date: 5% of the tax due per month, or part of a month, not to exceed

25%. See SC Code Section 12-54-43(C).

B. Failure to timely pay tax due: ½% per month, or part of a month, not to exceed 25%. See SC Code

Section 12-54-43(D).

C. Failure to timely deposit during the quarter: Not to exceed $1000. See SC Code Section 12-54-43(K).

INTEREST: SC Code of Law 12-54-25(A) states that if any tax is not paid when due, interest is due on the unpaid

portion from the time the tax was due until it is paid in its entirety.

Failure to file and/or pay penalties and interest can be determined by using the Penalty and Interest calculator found

on our website: >P&I Calculator.

REFUNDS

A refund will be issued, if the withholding is overpaid due to a math error or incorrect payment amount being sent.

Overpayments will be refunded to the withholding agent if claimed prior to the issuance of original W2 forms. See

SC Code Section 12-8-2020. Show any overpayment on the proper line of the return and a refund will be issued if

Department of Revenue records agree. No credits are allowed. Each quarter stands on its own.

Refunds are not allowed to the withholding agent due to the issuance of W2Cs (corrected W2s) which decrease the

amount of state tax withheld. Taxes withheld from an employee’s paycheck belong to the employee. Any

overpayment will be refunded from his or her individual income tax return.

CLOSING AN ACCOUNT

The withholding account can be closed if there is no withholding anticipated, even if the business remains open.

The withholding tax account can be reactivated within three (3) years with the same SC State withholding tax

account file number if the ownership remains the same. You may close the withholding account by any of the

following methods:

Darken the “Account Closed” circle on the WH1605 or WH1606

Complete the Account Closing Form (C-278) and mail to the address on the form.

File your return electronically using eWithholding (eWH) and enter the date of your last paycheck.

File your return using Business Tax TeleFile program and enter the date of your last paycheck.

Closing information furnished to other state or federal agencies is not provided to the South Carolina Department of

Revenue. You must close the account if the business is sold. If you close your withholding account during the year,

a WH1606 must be filed.

AMENDED RETURNS

To amend a return, use WH1605 or WH1606 and darken the circle for AMENDED return. Provide an explanation or

reason for the amendment. File an amended return only if corrections need to be made to an original return that has

already been filed. DO NOT amend a return if an original has not been filed. No amended WH1606 is necessary if

only correcting the wage amount (line 9). An amended return cannot be electronically filed or TeleFiled. Refunds

will not be issued to the withholding agent due to corrected W2s.

Forms can be downloaded from our website at under Forms and Instructions>Withholding. You may

also obtain forms by using our Fax on Demand service by calling 1-800-768-3676 or in Columbia, SC,

803-898-5320.

SUBMITTING W2S

Use form WH1612 to submit W2s and 1099s. W2s are due to the Department of Revenue on the last day of

February following the tax year. Only 1099 forms that have SC withholding tax should be sent to SCDOR.

For more information on the following topics, visit our website or call the Withholding Tax Questions

telephone numbers:

2009 Federal Military Spouses Residency Relief Act

2008 SC Illegal Immigration Reform Act and 7% Income Tax Withholding on Certain Persons

W-4 Information

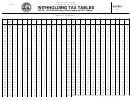

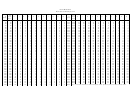

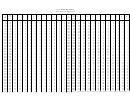

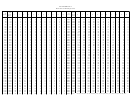

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19