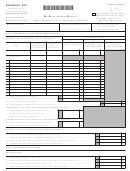

Form 112CR

2012 Colorado Corporation Credit Schedule

Column (b)

E.

Enterprise Zone Vacant Commercial Building Rehabilitation Credit

Column (a)

38. Qualified current year expenditures.

38

39. Smaller of $50,000 or 25% of line 38.

39

40. Rehabilitation credit carried over from prior year.

40

41. E

nter in Column (a) the total of lines 39 and 40. Enter in Column (b) the amount from Column (a)

which is being used to offset 2012 tax

41

F. Enterprise Zone Research And Experimental Credit

Qualifying current year expenditures

42.

42

43. First preceding year expenditures

43

44.

Second preceding year expenditures

44

Total of lines 43 and 44

45.

45

46. One-half of the amount on line 45.

46

Line 42 minus line 46

47.

47

48.

3% of the amount on line 47

48

25% of the amount on line 48

49.

49

25% of line 47 of 2009 Form 112CR

50.

50

25% of line 47 of 2010 Form 112CR

51.

51

25% of line 48 of 2011 Form 112CR

52.

52

Excess credit carried over from prior year

53.

53

54. E

nter in Column (a) the total of lines 49 through 53. Enter in Column (b) the amount from Column (a)

which is being used to offset 2012 tax

54

G. Miscellaneous Enterprise Zone Credits

55. E

nterprise zone job training credit. Enter in Column (b) the amount from Column (a) which is being

used to offset 2012 tax. Include in Column (a) any amount carried forward from the prior year.

55

Rural technology enterprise zone credit carryforward

56.

56

H. Other Credits

For the following other credits,

enter in Column (b) the amount from Column (a) which is being used to

offset 2012 tax. Include in Column (a) any amount carried forward from the prior year.

57. Old investment tax credit

57

58. Crop and livestock contribution credit

58

59. Historic property preservation credit (2012 credits must be carried forward to future years.)

59

60. Child care contribution credit (2012 credits must be carried forward to 2013.)

60

61. Child care center/family care home investment credit

61

62. Employer child care facility investment credit

62

63. School-to-Career investment credit

63

64. Colorado works program credit

64

65. Contaminated land redevelopment credit

65

66. Low-income housing credit

66

67. Aircraft manufacturer new employee credit

67

68. Job growth incentive credit

68

69. Gross conservation easement credit

69

70. Alternative fuel refueling facility credit

70

71. Nonrefundable alternative fuel vehicle credit carried forward from prior year

71

72. Total of lines 54b through 71b

72

73. Total nonrefundable credits, add amounts in Column (b), lines 6, 15, 16, 26, 37, 41, and 72

73

74. Refundable innovative motor vehicle credit. Enter here and on line 24 of Form 112

74

Limitation: The total credits entered on line 73 on this Form 112CR may not exceed the tax on line 1. Most unused portion(s)

of the credits on this form [the difference between the amounts in Column (a) and Column (b)] for each line may be carried

forward to the next income tax year. Please list any credits to be carried forward to tax year 2013 below.

75. Credits to be carried forward to 2013:

1

1 2

2