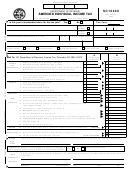

The following instructions refer to line numbers in Column C. If no changes are to be made to lines 1 - 14, use the amounts from the

original return.

Line 1:

Enter the corrected federal taxable income.

Line 2:

Enter the net amount of the changes to the additions (SC1040, Line 2) or subtractions (SC1040, Line 4)

from federal taxable income.

Line 3:

Modified South Carolina taxable income. Line 1 plus or minus line 2. Nonresidents should enter amount

from Part IV, line 34 of this form.

Line 4:

Use the tax tables for the tax year being amended to determine the corrected tax amount. Enter the

amount on line 4.

Line 5:

Make any necessary changes to the tax on lump sum distributions (Attach corrected SC4972), the tax on

active trade or business (Attach corrected I-335), and the tax on excess withdrawals from a Catastrophe

Savings Account.

Line 6:

Add lines 4 and 5. Enter the amount on line 6. This is the total South Carolina tax liability.

Lines 7 - 9:

Enter the corrected credit amounts.

Line 10:

Add lines 7 through 9. Enter the amount on line 10.

Line 11:

Subtract line 10 from line 6 and enter the amount on line 11.

Line 12:

Enter the corrected South Carolina withholding amounts. Attach supporting W-2(s) and/or 1099(s)

documenting the changes made to the total withholding amount.

Line 13:

Enter the corrected South Carolina estimated tax payment amount.

Line 14:

Enter the corrected tuition tax credit or other refundable credit(s) amount. Attach the appropriate corrected

credit form.

Line 15:

Enter the total tax paid with a South Carolina extension and/or original return and any additional payments

on line 15.

Line 16:

Add Column C line 12 through line 15. Enter the total on line 16.

Line 17:

Enter the net refund amount from the original return. Do not include estimated tax transfers or contribution

check-off amounts from the original return.

Line 18:

Subtract line 17 from line 16 and enter the amount on line 18.

Line 19:

Enter the amount of use tax paid on out of state purchases that was reported on your original return. Any

changes to the use tax amount must be made on form UT-3.

Line 20:

Enter the amount of transfers from the original return for estimated tax and/or contribution check-offs.

Line 21:

Add lines 19 and 20. Enter the amount on line 21.

Line 22:

Subtract line 21 from line 18 and enter the amount on line 22. This is the net tax.

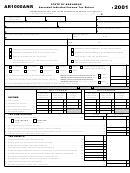

If line 22 is larger than Column C line 11, subtract line 11 from line 22 and enter the difference on line 23.

Line 23:

This is the amount to be refunded to you. Overpayments cannot be transferred to another tax year.

Required: Mark your refund choice below on line 23a.

You now have three ways to receive your refund. You can choose direct deposit to have the funds

Line 23a:

deposited directly into your bank account (the fastest option for most filers), or you can choose to have a

debit card or a paper check mailed to you. Debit cards are issued by Bank of America and are subject to

program limitations. Mark an X in one box to indicate your choice. If you choose direct deposit, you must

enter your account information on line 23b.

2

1

1 2

2 3

3 4

4 5

5 6

6