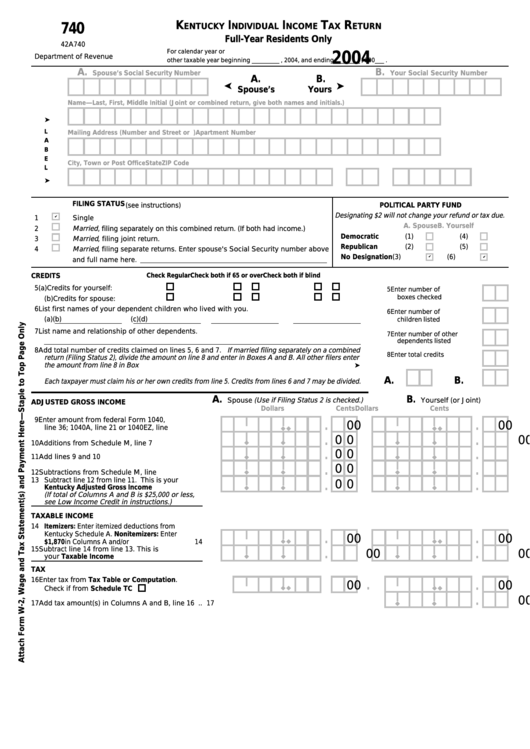

K

I

I

T

R

740

ENTUCKY

NDIVIDUAL

NCOME

AX

ETURN

Full-Year Residents Only

42A740

For calendar year or

2004

Department of Revenue

other taxable year beginning _________ , 2004, and ending ________ , 200___ .

A.

B.

Spouse’s Social Security Number

Your Social Security Number

A.

B.

Spouse’s

Yours

Name—Last, First, Middle Initial (Joint or combined return, give both names and initials.)

L

Mailing Address (Number and Street or P.O. Box)

Apartment Number

A

B

E

City, Town or Post Office

State

ZIP Code

L

FILING STATUS (see instructions)

POLITICAL PARTY FUND

Designating $2 will not change your refund or tax due.

1

Single

A. Spouse

B. Yourself

2

Married , filing separately on this combined return. (If both had income.)

Democratic

(1)

(4)

Married , filing joint return.

3

Republican

(2)

(5)

Married , filing separate returns. Enter spouse's Social Security number above

4

No Designation

(3)

(6)

and full name here.

Check Regular

Check both if 65 or over

Check both if blind

CREDITS

5 (a) Credits for yourself:

5 Enter number of

boxes checked

(b) Credits for spouse:

6 List first names of your dependent children who lived with you.

6 Enter number of

(a)

(b)

(c)

(d)

children listed

7 List name and relationship of other dependents.

7 Enter number of other

dependents listed

8 Add total number of credits claimed on lines 5, 6 and 7. If married filing separately on a combined

8 Enter total credits

return (Filing Status 2), divide the amount on line 8 and enter in Boxes A and B. All other filers enter

the amount from line 8 in Box B ...............................................................................................................

A.

B.

Each taxpayer must claim his or her own credits from line 5. Credits from lines 6 and 7 may be divided.

A.

B.

Spouse (Use if Filing Status 2 is checked.)

Yourself (or Joint)

ADJUSTED GROSS INCOME

Dollars

Cents

Dollars

Cents

9 Enter amount from federal Form 1040,

0

0

0

0

.

.

line 36; 1040A, line 21 or 1040EZ, line 4 .........

9

0

0

0

0

.

.

10 Additions from Schedule M, line 7 ................. 10

0

0

0

0

.

.

11 Add lines 9 and 10 ............................................ 11

0

0

0

0

.

.

12 Subtractions from Schedule M, line 17 .......... 12

0

0

0

0

13 Subtract line 12 from line 11. This is your

.

.

Kentucky Adjusted Gross Income .................... 13

(If total of Columns A and B is $25,000 or less,

see Low Income Credit in instructions.)

TAXABLE INCOME

14 Itemizers: Enter itemized deductions from

0

0

0

0

Kentucky Schedule A. Nonitemizers: Enter

.

.

$1,870 in Columns A and/or B ............................. 14

0

0

0

0

15 Subtract line 14 from line 13. This is

.

.

your Taxable Income ........................................ 15

TAX

16 Enter tax from Tax Table or Computation.

0

0

0

0

.

.

Check if from Schedule TC

.................... 16

0

0

.

17 Add tax amount(s) in Columns A and B, line 16 .................................................................................. 17

1

1 2

2