Form Cm-1 - Offer In Compromise Page 3

Download a blank fillable Form Cm-1 - Offer In Compromise in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form Cm-1 - Offer In Compromise with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

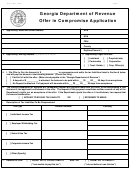

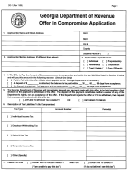

FORM CM-1 (REV. 2014)

PAGE 3

Section 6

Offer Terms

By submitting this offer, I/we have read, understand and agree to the following terms and conditions:

1. I request that the Department of Taxation (Department) accept the offer amount listed in this offer application as

payment of my outstanding tax debt (including interest, penalties, and additions to tax) as of the date listed on this

form. I authorize the Department to amend Section 2 on page 1 in the event that I failed to list or incorrectly listed any

of my assessed tax debt.

2. I voluntarily submit the payments made on this offer and understand that they are not refundable even if I withdraw

the offer or the Department rejects or returns the offer. The Department will keep all payments and other credits it has

collected prior to this offer and any payments that I make relating to this offer.

3. I understand that the Department will keep all payments, credits, refunds, including interest, that I might be due for tax

periods extending through the calendar year in which the Department accepts my offer. I cannot designate that these

amounts be applied to estimated tax payments for the following year or the accepted offer amount. If I receive a refund

after I submit this offer for any tax period extending through the calendar year in which the Department accepts my

offer, I will return the refund immediately to the Director of Taxation (Director).

4. The payments and all other amounts kept by the Department shall be applied to my tax debt in the best interest of the

State and in a manner consistent with section 231-27, Hawaii Revised Statutes.

5. If I fail to meet any of the terms of this offer, the Department may take collection actions against me without further

notice. These actions may include, but are not limited to levying my property, filing a civil suit against me, garnishing

my wages, and referral to a private collection agency. The Department will attempt to collect any amount ranging from

the unpaid balance of the offer to the original amount of the tax debt, interest on the unpaid balance at the rate of 8

percent per year, and cost recovery fees. If I fail to meet any terms of this offer, I waive the right to contest, in court or

otherwise, the amount of the tax debt.

6. I understand that my offer does not relieve me of the tax liabilities (including interest, penalties, and additions to tax)

listed in this offer unless and until it is actually accepted in writing by the Director or his authorized representative,

approved by the Governor (where applicable), and the terms of the offer have been satisfied. Once the Department

accepts my offer in writing, I waive all rights to contest, in court or otherwise, the amount of the tax debt.

Section 7

Signature of Taxpayer(s)

If this is a joint offer, then both spouses must sign the form. If signed by a corporate officer, partner, limited liability com-

pany member, guardian, tax matters partner/person, executor, receiver, administrator, or trustee on behalf of the taxpayer,

I certify that I have the authority to execute this form on behalf of the taxpayer. I declare that this offer (including any ac-

companying schedules or statements) has been examined by me and, to the best of my knowledge and belief, it is true,

correct, and complete.

Signature

Title

Date

Print name

Print taxpayer's name if the taxpayer is not an individual

Signature

Title

Date

Print name

Section 8

Paid Preparer Use Only

Date

Preparer's

Check if self-employed

signature

Preparer's identification no.

Federal employer identification number

Print preparer's

name

Firm's name (or yours

if self-employed),

address and ZIP Code

FORM CM-1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3