Instructions For Withholding Pa Personal Income Tax From Nonresident Owners By Partnerships And Pa S Corporations

ADVERTISEMENT

REV-413(P/S) EX (08-10)

INSTRUCTIONS FOR WITHHOLDING PA PERSONAL

PA DEPARTMENT OF REVENUE

INCOME TAX FROM NONRESIDENT OWNERS BY

PARTNERSHIPS AND PA S CORPORATIONS

PART 1. GENERAL INSTRUCTIONS

When submitting the final nonresident withholding tax (catch-up) pay-

ment for nonresident owners that are individuals, estates, or trusts,

Partnerships and PA S corporations with taxable PA-source income are:

print the last four digits of the entity's federal employer identification

• Jointly liable with their nonresident partners and shareholders for

number (FEIN) and 2011 Final Nonresident Withholding on the check

payment of tax on such income to the extent allocable to the non-

or money order made payable to the PA Dept. of Revenue.

residents; and

When using approved software, submit the 2011 Nonresident

• Authorized and required to collect such tax from their nonresi-

Withholding Payment substitute voucher with a check or money

dent owners and remit the tax to Pennsylvania.

order and submit with the PA-20S/PA-65 Information Return, PA-40

The imposition of the tax against the partnership or PA S corporation

NRC or extension request.

does not change the filing requirements or the tax liability of its non-

resident owners.

Federal/State e-File

The final nonresident withholding tax (catch-up) payment can only

The nonresidents take credit for the tax withheld on their annual

be filed electronically when submitted with the return. Visit

returns and treat their income from the partnership or PA S corpora-

for more information.

tion as income subject to withholding in calculating any other per-

sonal estimated taxes. The nonresidents may not deduct their per-

COLLECTION OF NONRESIDENT WITHHOLDING TAX

sonal estimated tax payments from the tax imposed on the partner-

If the partnership or PA S corporation maintains a drawing account

ship or PA S corporation.

for, or makes distributions or guaranteed payments to its nonresi-

NONRESIDENT PARTNER OR SHAREHOLDER

dent partner or shareholder and the withdrawals or distributions are

The terms nonresident partner and nonresident PA S corporation

sufficient to cover the tax, PA law authorizes and requires the entity

shareholder include owners that are nonresident individuals, non-

to deduct the tax from the drawing account or distribution when

resident inter vivos or testamentary trusts or nonresident dece-

credited. Otherwise, the time and manner of collection of the tax

dents' estates.

shall be a matter of settlement between the partnership or PA S cor-

poration and its partners or shareholders.

The entity may rely on its business records to determine the identi-

ty, the place of residence and the distributive share of income and

PART 3. STATEMENT OF NONRESIDENT WITHHOLDING TAX

losses of each partner or shareholder. The entity may rely on such

Each entity with income from sources within Pennsylvania must pro-

records, unless and until the entity receives a notice furnished under

vide each of its nonresident owners with a PA-20S/PA-65 Schedule

federal temporary regulation § 1.6031(c)-1t.

NRK-1 showing the owner’s income, credits and tax withheld.

PART 2. PAYMENT OF NONRESIDENT WITHHOLDING TAX

PART 4. FORMS COMPLETION INSTRUCTIONS

All partnerships and PA S corporations must collect and pay nonres-

Use the Partnerships and PA S Corporations Withholding Tax

ident quarterly withholding tax. Use Part A and Part B of Form REV-

414(P/S), Partnerships and PA S Corporations Withholding Tax

Worksheet (REV-414(P/S)) to determine the nonresident quarterly

Worksheet, to figure the correct amount of 2011 nonresident quar-

withholding amount. Use Form PA-40ES (P/S) or Form PA-40ESR

terly withholding tax. If the aggregate 2011 nonresident quarterly

(F/C), Declaration of Estimated Personal Income Tax, to pay the

withholding tax will be less than $500, the entity must pay within 30

2011 nonresident quarterly withholding tax.

days of the close of the taxable year.

Use Part A and Part B of Form REV-414(P/S) to figure the correct

If the aggregate 2011 nonresident quarterly withholding tax will be

amount of 2011 nonresident quarterly withholding tax to pay. Keep

$500 or more, the entity may either pay all of the nonresident tax with

a record of nonresident quarterly withholding tax payments made

the first payment or pay in installments when due. Use this table to

and the amount of remaining nonresident quarterly payments on

determine the amount and due date for each installment of nonres-

the Record of Withholding Tax Payments. Use Part D of Form

ident tax. If the due date falls on a Saturday, Sunday or legal holi-

REV-414(P/S) to figure the correct balance of nonresident quar-

day, the due date is the next business workday. Interest on under-

terly withholding tax due when filing the 2011 PA-20S/PA-65

payments of nonresident quarterly withholding tax shall run from

Information Return. Use Form PA-40ES (P/S) or Form PA-40ESR

the due date to the 30th day following the close of the taxable year.

(F/C) forms for properly paying the nonresident quarterly withhold-

ing tax.

FINAL CATCH-UP PAYMENT OF NONRESIDENT

WITHHOLDING TAX

If the partnership or PA S corporation does not receive its

preprinted Forms PA-40ES (P/S) or the forms are damaged, use

If the tax of the nonresident owners exceeds the nonresident quar-

terly withholding tax payments, the partnership or PA S corporation

Form PA-40ESR (F/C). See Forms Ordering in Part 7. Failure to

receive department-provided forms does not relieve a partnership

must pay the deficiency by the date prescribed for filing the entity's

PA-20S/PA-65 Information Return.

or PA S corporation from filing and paying the tax.

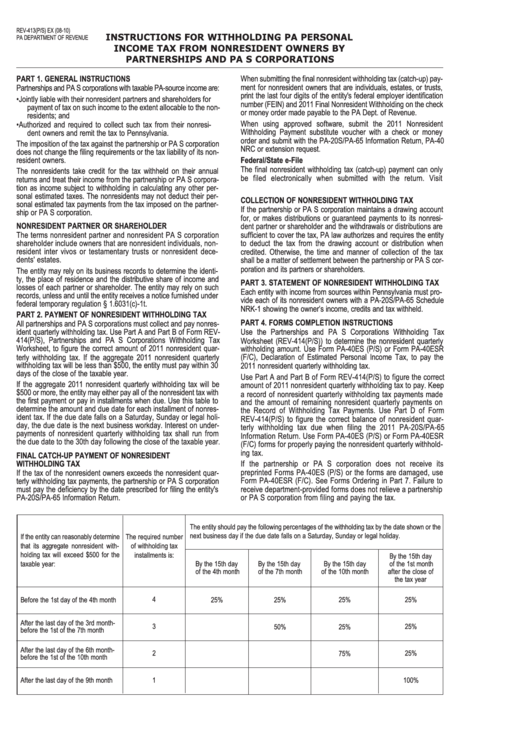

The entity should pay the following percentages of the withholding tax by the date shown or the

next business day if the due date falls on a Saturday, Sunday or legal holiday.

If the entity can reasonably determine

The required number

that its aggregate nonresident with-

of withholding tax

holding tax will exceed $500 for the

installments is:

By the 15th day

By the 15th day

By the 15th day

By the 15th day

of the 1st month

taxable year:

of the 4th month

of the 7th month

of the 10th month

after the close of

the tax year

Before the 1st day of the 4th month

4

25%

25%

25%

25%

After the last day of the 3rd month-

3

25%

50%

25%

before the 1st of the 7th month

After the last day of the 6th month-

2

75%

25%

before the 1st of the 10th month

After the last day of the 9th month

1

100%

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2