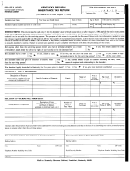

Form 101s - Wisconsin Spousal Inheritance Tax Return Page 2

ADVERTISEMENT

INSTRUCTIONS FOR FORM 101S

INTRODUCTION

HOW TO PREPARE FORM 101S

Form 101S is designed to simplify the reporting require-

Form 101S is easy to complete. Simply read the form

ments for Wisconsin inheritance tax purposes in those

carefully and provide all the information requested. If you

estates where the surviving spouse is the only person

indicate on Form 101S that the decedent had a will, trust

receiving property upon a decedent’s death (see exception

agreement(s) and/or marital property agreement(s) at death,

below) and no inheritance tax will be due.

submit copies of all existing documents with Form 101S

when it is filed. If any of the information and/or documents

This form may be used regardless of the type of proceed-

are omitted, the processing of this form will be delayed.

ing (for example, formal or informal probate, termination of

joint tenancy, summary settlement, summary assignment,

Since no inheritance tax is owed by a surviving spouse,

register of deeds form, or transfer by affidavit) used to

it is not necessary to list the decedent’s property passing

administer the decedent’s estate or to transfer property to

to the surviving spouse nor any deductions (for example,

the surviving spouse.

funeral expenses, last illness expense, debts or adminis-

tration expenses) pertaining to the decedent’s estate or

property.

WHEN THIS FORM CAN BE USED

This form may be used if the decedent died after June 30,

Be sure to file both copies of this form with the Department.

1982 and before January 1, 1992. July 1, and the surviving

spouse, with one exception, is the only person receiving

CERTIFICATE DETERMINING NO INHERITANCE TAX

property because of the decedent’s death.

After the Department has reviewed this form, it will stamp

Copy 1 indicating that no inheritance tax is due. Copy 1 will

EXCEPTION: If natural or adopted issue of a decedent

be returned to the estate, generally within 4 weeks after

receive property totalling $5,000 or less, this form may still

Form 101S is filed.

be used. “Issue” includes the decedent’s children (includ-

ing a son-in-law and daughter-in-law) and grandchildren.

The property received by all issue must be described in

RELEASING JOINT PROPERTY

Schedule A below.

For deaths on or after July 1, 1982, any personal property

which a surviving spouse is entitled to receive from a de-

If any of these conditions is not met, Wisconsin inheritance

cedent may be transferred to the surviving spouse without

tax return, Form 101 or Form 101A, must be filed.

obtaining the consent of the Department. Personal property

includes such items as stocks, bonds, notes, mortgages,

savings and checking accounts, and contents of safe

WHERE TO GET FORMS AND INFORMATION

deposit boxes.

Information, additional forms and assistance are available

at the following Department of Revenue office:

CLOSING CERTIFICATE FOR FIDUCIARIES

2135 Rimrock Rd.,

or write to –

If this certificate is required in any Circuit Court proceed-

Madison, WI

PO Box 8906

ing held to close an estate, a copy of the inventory must

Phone (608) 266-2772

Madison, WI 53708

accompany the request for this certificate.

SCHEDULE A — PROPERTY PASSING TO

Indicate below the property passing to each issue. Remember, if the total value of all property passing to all issue exceeds, $5,000, this form may not

be used.

For inheritance tax purposes, property must be valued at its fair market value as of the decedent’s death. If you have any questions regarding how to

determine fair market value, please call us.

(indicate nature of property, its fair market value at decedent’s death and how

Name of Issue

Relationship

Property Received

value determined)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2