Form Wv/mitc-1 - Schedule Mitc-1 Credit For Manufacturing Investment Page 7

ADVERTISEMENT

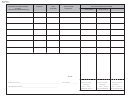

Line 12e.

Enter sum of Industrial Expansion and Revitalization Credit, Research and Development Project Credit,

Residential Housing Development Credit, and Aerospace Industrial Facility Credit if any, applied against your

Business Franchise Tax liability.

Line 12f.

Subtract Line 12e from Line 12d.

Line 12g.

Enter the lesser of Line 11, or Line 12c, or Line 12f. This represents the maximum Manufacturing Investment Tax

Credit available against your Business Franchise Tax liability. Also, enter this amount on the Tax Recap

Schedule of the tax return.

Line 13.

Annual Manufacturing Investment Tax Credit adjusted for Business Franchise Tax Claim – Subtract the

amount on line 12g from the amount on line 11.

Line 14a.

Enter total pre-credit Corporation Net Income Tax liability.

Line 14b.

Enter sum of all other credits, if any, applied against your Corporation Net Income Tax liability.

Line 14c.

Subtract Line 14b from 14a.

Line 14d.

Corporation Net Income Tax Manufacturing Investment Tax Credit Limit – Multiply the amount on line 14a

by the Credit Offset Factor from Line 9.

Line 14e.

Enter sum of Industrial Expansion and Revitalization Credit, Research and Development Project Credit,

Residential Housing Development Credit, and Aerospace Industrial Facility Credit if any, applied against your

Corporation Net Income Tax liability.

Line 14f.

Subtract Line 14e from Line 14d.

Line 14g.

Enter the lesser of Line 13, or Line 14c, or Line 14f. This represents the maximum Manufacturing

Investment Tax Credit available against your Corporation Net Income Tax liability. Also, enter this amount

on the Tax Recap Schedule of the tax return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7