Arizona Booklet 120es - Corporation Estimated Tax Payment - 2011 Page 12

ADVERTISEMENT

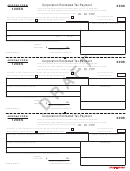

Estimated Tax Worksheet for Corporations

ARIZONA FORM

2011

120W

(Taxpayers Filing Forms 99T, 120, 120A, and 120S)

1 Arizona tax liability - see instructions before completing this line ..................................................................................

1

00

2 Required annual payment.

a Enter 90 percent of line 1 .................................................................................................

2a

00

b Forms 99T, 120, and 120A - enter the tax as shown on the 2010 return. See instr..........

2b

00

c Form 120S. See instructions ............................................................................................

2c

00

d Forms 99T, 120, and 120A - enter the smaller of line 2a or line 2b. Form 120S - enter the smaller of line 2a or line 2c...... 2d

00

Required Installments - Due Dates and Amounts

(a)

(b)

(c)

(d)

3 Installment due dates. See instructions .............................

3

4 Required installments. Enter 25 percent of line 2d in

columns (a) through (d) unless the taxpayer uses the

annualized income installment method, the adjusted

seasonal installment method or is a “large corporation”. See instr. 4

Schedule A - Required Installments Using the Annualized Income or Adjusted Seasonal Installment Methods Under IRC § 6655(e)

Part I - Annualized Income Installment Method

(a)

(b)

(c)

(d)

First____

First____

First____

First____

Months

Months

Months

Months

1 Annualization periods. See instructions ................................................................

1

2 Enter taxable income for each annualization period .............................................

2

3 Annualization amounts. See instructions ..............................................................

3

4 Annualized taxable income. Multiply line 2 by line 3.............................................

4

5 Calculate the tax on the amount in each column on line 4. See instructions .......

5

6 Enter tax from recapture of tax credits for each payment period - see instr. ...........

6

7 Subtotal tax. Add lines 5 and 6 .............................................................................

7

8 Clean Elections Fund Tax Reduction ($5). See instructions .................................

8

9 For each period, enter the amount of nonrefundable tax credits. See instr. ...........

9

10 Arizona tax liability - subtract the sum of lines 8 and 9 from line 7. If zero or less,

enter zero..............................................................................................................

10

11 Clean Elections Fund Tax Credit. See instructions ...............................................

11

12 Tax liability after Clean Elections Fund tax credit. Subtract line 11 from line 10 ...

12

13 Refundable tax credits - see instructions ..............................................................

13

14 Claim of right adjustment - see instructions ..........................................................

14

15 Net liability - subtract the sum of line 13 and line 14 from line 12. If less than zero,

enter zero ..............................................................................................................

15

22.5%

45%

67.5%

90%

16 Applicable percentage ..........................................................................................

16

17 Multiply line 15 by line 16......................................................................................

17

18 Add the amounts in all preceding columns from page 2, Part III, line 54 - see instr. ....

18

19 Annualized income installments. Subtract line 18 from line 17. If zero or less,

enter zero..............................................................................................................

19

Part II - Adjusted Seasonal Installment Method

(Caution: Use this method only if the base period percentage of any 6 consecutive

(a)

(b)

(c)

(d)

months is at least 70%. See the instructions for more information.)

First 3

First 5

First 8

First 11

Months

Months

Months

Months

20 Enter taxable income for the following periods:

a Taxable year beginning in 2008 ........................................................................

20a

b Taxable year beginning in 2009 ........................................................................

20b

c Taxable year beginning in 2010 ........................................................................

20c

21 Enter taxable income for each period for taxable year beginning in 2011 ............

21

ADOR 10551 (10)

Previous ADOR 91-5344

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18