Arizona Booklet 120es - Corporation Estimated Tax Payment - 2011 Page 2

ADVERTISEMENT

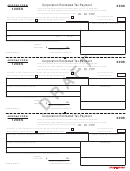

2011

Corporation Estimated Tax Payment

ARIZONA FORM

120ES

This estimated payment is for taxable year ending

MM DD YYYY

MM DD YYYY

.

†

Check box if: This is the fi rst year you are fi ling a tax return under this name and EIN

†

Name, address, or EIN has changed

The enclosed amount

If EIN has changed, list prior number

is payment number

Name of fi rm - exactly as it will appear on the return

Employer identifi cation number (EIN)

1

Address - number and street or PO Box

Business telephone number

2

(

)

Address continued

REVENUE USE ONLY. DO NOT MARK IN THIS AREA.

2

City

State

ZIP code

3

You must round your estimated payment to a whole dollar (no cents).

PAYMENT

.00

$

ENCLOSED

Make check payable to:

Arizona Department of Revenue

Include EIN on Payment.

Mail to:

Arizona Department of Revenue

PO Box 29085

Phoenix, AZ 85038-9085

NOTE: To ensure proper application of this payment, this form must be completed in its entirety.

General Instructions

Obtain additional information or assistance by calling one of

Refer to Arizona Individual Income Tax Ruling ITR 97-1 for

the numbers listed below:

additional information regarding composite returns.

Estimated Tax Payments by Electronic Funds

Phoenix

(602) 255-3381

Transfer

From area codes 520 and 928, toll-free

(800) 352-4090

Hearing impaired TDD user

Phoenix

(602) 542-4021

Refer to ARS § 42-1129 and the related Arizona Administrative

From area codes 520 and 928, toll-free

(800) 397-0256

Code rules (AAC R15-10-301 through R15-10-307) for detailed

information regarding electronic funds transfer.

Obtain tax rulings, tax procedures, tax forms and instructions,

and other tax information by accessing the department’s

Taxpayers whose Arizona corporate income tax liability for the

Internet home page at

preceding taxable year was $20,000 or more must make Arizona

corporate estimated tax payments via the electronic funds

transfer program. If the taxpayer makes its estimated tax

Who Should Use Form 120ES

payments by electronic funds transfer (EFT), the taxpayer

should not submit Form 120ES to the department.

This form should be used by entities fi ling Forms 99T, 120,

120A, and 120S that are required to make Arizona estimated

NOTE:

Beginning for reporting periods from and after

tax payments. Payments can be made via check, electronic

February 28, 2011, taxpayers required to make corporate

check, money order, or credit card. The taxpayer should not use

estimated payments via EFT that fail to do so will be subject

Form 120ES if the taxpayer makes its required installments of

to a penalty of 5%. See ARS § 42-1125(O).

estimated tax by electronic funds transfer (EFT) or over the internet.

Visit to register and make payments via the

Taxpayers required to make estimated tax payments via

internet.

electronic funds transfer must complete the department’s

electronic funds transfer authorization agreement at least 30

S corporations and partnerships must use Form 140ES to

days prior to initiation of the fi rst applicable transaction.

make voluntary estimated tax payments on a composite basis

on behalf of nonresident individual shareholders or nonresident

individual partners participating in the fi ling of a composite return

on Form 140NR.

ADOR 10339 (10)

Previous ADOR 91-0027

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18