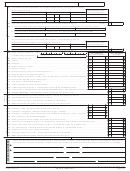

Arizona Form 140py - Part-Year Resident Personal Income Tax Art-Year Resident Personal Income Tax - 2011 Page 6

ADVERTISEMENT

Form 140PY

status. This procedure is ITP 92-1. To see this procedure,

What Are the Filing Dates and Penalties?

visit our web site at and click on legal

research and then click on procedures.

When Should You File?

You have extra time to file and pay for 2011 because April

Residents

15, 2012 falls on a Sunday and April 16, 2012 is a legal

You are a resident of Arizona if your domicile is in Arizona.

holiday in Washington DC. This means that your 2011

Domicile is the place where you have your permanent home. It

calendar year tax return is due no later than midnight, April

is where you intend to return if you are living or working

17, 2012. File your return as soon as you can after January

temporarily in another state or country. If you leave Arizona

1, but no later than April 17, 2012.

for a temporary period, you are still an Arizona resident while

If you are a fiscal year filer, your return is due on the 15th day

gone. A resident is subject to tax on all income no matter

of the fourth month following the close of your fiscal year.

where the resident earns the income.

What if You Cannot File on Time?

If you are a full year resident, you must file Form 140, Form

You may request an extension if you know you will not be

140A, or Form 140EZ.

able to file on time.

Part-Year Residents

NOTE: An extension does not extend the time to pay your income

If you are a part-year resident, you must file Form 140PY,

tax. For details, see the instructions for Arizona Form 204.

Part-Year Resident Personal Income Tax Return.

You are a part-year resident if you did either of the

To get a filing extension, you can either:

following during 2011.

1.

Apply for a state extension (Form 204). To apply for a

x

You moved into Arizona with the intent of becoming a

state extension, file Arizona Form 204 by April 17. See

resident.

Form 204 for details. You do not have to attach a copy of

the extension to your return when you file, but make sure

x

You moved out of Arizona with the intent of giving up

that you check box 82F on page 1 of the return. If you

your Arizona residency.

must make a payment, use Arizona Form 204, or visit

Nonresidents

to make an electronic payment.

If you are a nonresident, you must file Form 140NR,

2.

You may use your federal extension (federal Form

Nonresident Personal Income Tax Return.

4868). File your Arizona return by the same due date.

You do not have to attach a copy of your federal

What if a Taxpayer Died?

extension to your return, but make sure that you check

If a taxpayer died before filing a return for 2011, the

box 82F on page 1 of the return.

taxpayer's spouse or personal representative may have to file

and sign a return for that taxpayer.

A personal

When Should You File if You are a

representative can be an executor, administrator, or anyone

Nonresident Alien?

who is in charge of the deceased taxpayer’s property.

The due date for your Arizona return is not the same as the

If the deceased taxpayer did not have to file a return but had

due date for your federal return. Your Arizona return is due

tax withheld, a return must be filed to get a refund.

by April 17 even though your federal return is due on June

The person who files the return should use the form the

15. If you want to file your Arizona return after April 17, you

taxpayer would have used. If the department mailed the

must ask for a filing extension. You must file this request by

taxpayer a booklet, do not use the label. The person who

April 17. Arizona will allow up to a 6-month extension.

This will allow you to file your return by October 15,

files the return should print the word "deceased" after the

2012. See Form 204 for extension filing details.

decedent's name in the address section of the form. Also

enter the date of death after the decedent's name.

If you have a federal 6-month extension, you can file

If your spouse died in 2011 and you did not remarry in

your Arizona return under that extension. If you file

2011, or if your spouse died in 2012 before filing a return

using your federal extension, Arizona will also allow

for 2011, you may file a joint return. If your spouse died in

you an extra 6 months. Because we will allow only 6

2011, the joint return should show your spouse's 2011

months, the due date for your Arizona return is not the

income before death, and your income for all of 2011. If

same as the due date for your federal return. In this

your spouse died in 2012, before filing the 2011 return, the

case, your Arizona return will be due by October 15

joint return should show all of your income and all of your

even though your federal return will not be due until

spouse's income for 2011. Print "Filing as surviving spouse"

December 15. If you file your 2011 Arizona calendar year

in the area where you sign the return. If someone else is the

return after October 15, 2012, your return will be late.

personal representative, he or she must also sign the return.

If you are a fiscal year filer, your return is due on the 15th day

of the fourth month following the close of your fiscal year.

Are Any Other Returns Required?

You may also have to file a fiduciary income tax return (Form

What if You File or Pay Late?

141AZ). For details about filing a fiduciary income tax return,

If you file or pay late, we will charge you interest and

call the department at (602) 255-3381.

penalties on the amount you owe. If the U.S. Post Office

postmarks your 2011 calendar year return by April 17, 2012,

Claiming a Refund for a Deceased Taxpayer

your return will not be late. You may also use certain private

If you are claiming a refund for a deceased taxpayer, you

delivery services designated by the IRS to meet the “timely

must complete Form 131, Claim for Refund on Behalf of

mailing as timely filed” rule.

Deceased Taxpayer. Attach this form to the front of the

return.

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45