FORM A-777a INSTRUCTIONS

MTA ACCOUNT AUTHORIZATION

In order for the taxpayer’s representative to register for, file returns and access information on behalf

of the taxpayer, the Wisconsin Department of Revenue requires the taxpayer’s representative to hold

a My Tax Account authorization form, or other written authorization, executed by the taxpayer. The use

of Form A‑777a is not mandatory, however, a substitute form must reflect the information that would be

provided on Wisconsin Form A-777a.

Do not send a copy of Form A-777a to the Wisconsin Department of Revenue. The taxpayer and

his/her representative should retain an executed copy of Form A-777a in their records.

HOW TO COMPLETE FORM A-777a

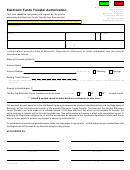

Taxpayer Information

1. For individuals: Enter your name, address, social security number, Wisconsin Tax Number (WTN),

telephone number and email address in the space provided.

2. For a corporation or partnership: Enter the name, business address, federal identification number

(FEIN), Wisconsin tax number (WTN), telephone number and email address.

3. For any other entity: Enter the name, business address, federal identification number (FEIN),

telephone number and email address.

Authorization

Enter the name, address, and telephone number of each individual authorized.

Revoking an Authorization

You must remove the third party access in your own My Tax Account profile settings. This is done by logging

into the My Tax Account website at https://tap.revenue.wi.gov and completing the following steps: click

on the My Profile option, click on the Manage Logons button, click on the third party representative’s ID

listed below the green bar for Web Logons and edit their access to NO. This will revoke the previous

authorization.

Signature of Taxpayer(s)

The Authorization must be signed by the taxpayer. A signature stamp is not acceptable.

1. For individuals: The taxpayer must sign.

2. For partnerships: All partners must sign unless one partner is authorized to act in the name of the

partnership.

3. For corporations and any other entity: A corporate officer or person having authority to bind the

entity must sign.

Date: The Authorization should be dated when signed.

1

1 2

2